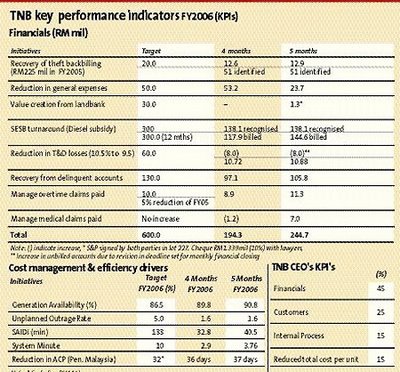

The Star bizweek interview of Tenaga chief Datuk Che Khalib Mohamad Noh reveal Tenaga's Key Performance Indicators (KPI)

Majority of the KPI reveal by CEO are mainly in financial term : recovery of debt, reduction in general expenses, value creation from land bank, SESB turnaround, recovery from delinquent accounts, average collection period, return on asset, procurement process time.

undeniable, he also reveal some technical KPIs like generation availability and productivity KPI like staff response time and number of kilowatt or megawatt produced per staff.

Datuk Che Khalid further reveal that for Senior Management. They have four quadrants of KPIs: Financials (45%), customers (25%), internal process (15%), and reduced total cost per unit (15%).

Based on the four quadrants. Does it balance?

With Financial cover 45%. It is hardly for me to said it is balance. Further, it is debatable whether reduced total cost per unit (15%) should be under Financial (45+15=65%) or Internal Process (15+15=30%)

Che Khalid is correct by mentioning that "we need the customer more than the customer needs us. Everything else will fall into place. If you take really good care of the customer than they will be willing to pay more for your really good service."

However, customers cover 25% is reasonable. However, Che Khalid never reveal what comprise customer KPI. It should included number of complaint received, number of compliment letter received or published on newspaper. Customer waiting time. Tenaga should follow EPF and Public Bank Bhd in reducing customer waiting time.

I feel that Financial should reduced to 25% to 30%.

One thing left out from the Balanced Scorecard system is Innovation. There is no KPI in Innovation. Like new method to read meter, new method to collect bill etc.

Too focus on financial KPI lead to management take an easy way out : tariff hike. More emphasis should be place on Customer, Internal Process and Innovation.

Instead, Tenaga should do what Che Khalid mentioned Take good care of the customer by tariff reduction to induced Foreign Direct Investment (FDI). Then Tenaga revenue would improved if a lot of foreigner set up factory here. Of course, they should minimise black out and other customer issue. Thus, I feel Customer KPI is more important.

TechnoratiTag:Business Commentary Economics Economy Malaysia News and politics Opinion Politik Shares Stock Market klse