On 29 November 2006, The Star reported that THE New Straits Times Press (M) Bhd (NSTP) is planning to acquire Utusan Melayu (M) Bhd to forge a strong alliance between its Berita Harian and Utusan Malaysia. AmInvestment Group and BNP Paribas have been appointed to structure the deal.

On Friday, 1 December 2006, New Straits Times Press (Malaysia) Bhd and Utusan Melayu (Malaysia) Bhd announced the suspension until Monday ahead of a potential merger.

On 2 December 2006, The Star reported that merger deal has been sent back to the drawing board hours after Umno president Datuk Seri Abdullah Ahmad Badawi called for the tradition and histories of the newspapers to be maintained after UMNO supreme council meeting.

On 4 December 2006, The star reported that In a joint statement to Bursa Malaysia Monday, the newspaper publishers said the companies' board of directors had been "exploring ways to enhance the value of both groups via a possible merger." "Utusan and NSTP intend to continue to explore and discuss this matter further and have entered into a non-disclosure agreement to govern the period of discussion," the companies said. An immediate announcement shall be made to the exchange should a final agreement materialise, they added.

Today. The Star reported that NSTP, Utusan shares down on profit-taking

Lets examine the Political, Economic, Social and Technology (PEST analysis) on this merger:

Political and Social

Politically, several UMNO supreme council members voiced their concern over the deal and also the long connection between the party and Utusan Malaysia in. One of the main concerns was the independency of Utusan Malaysia as the Malays shared strong sentiment for the oldest Malay newspaper in the country.They told the meeting they feared that any merger which could affect the identity of the Malay daily would backfire on the party, although Umno would continue to control it.

EONCap Securities head of research Pong Teng Siew in an interview by The Star said that the merger could face resistance from investment and fund managers as well as from some press factions, as investment managers would prefer more stocks to work with instead of a single large entity, and certain sections of the media could consider the status quo as something sentimental''.

Even the non-bumiputra group also concern about the merger and said that this might curtail press freedom.

For me, I feel the meger do more good that harm to Malaysia politically and socially. Utusan Malaysia and Berita Harian, two different independent Malay newspaper compete with each other in playing up sensitive and sentimental issue to gain their respective market shares. This is no good politically and socially to promote harmony and cooperation within difference race in Malaysia. By merging the two entity under one shareholder, they need not use such technique to compete with each other. They only compete with PAS control Harakah and I feel this is better politically and socially.

Even during reformasi. Party Keadilan Rakyat call for reader to read Harakah and they boycott of both newspaper(Utusan and Berita Harian). Thus, it is wrong to say that the merger will curtail press freedom. There is no difference whether you buy Utusan or Berita Harian as both newspaper are head by people loyal to UMNO. By merging the two entity, we get less sensitive and sentimental report and it is better politically and socially for Malaysia.

Economic Analysis

EONCap Securities head of research Pong Teng Siew said the merger could face resistance from investment and fund managers as investment managers would prefer more stocks to work with instead of a single large entity. Thus, it is better to keep Utusan Malaysia listing status. Keeping Utusan listing status by injecting Berita Harian to Utusan Malaysia would allow investor to invest in NSTP, an English newspaperr company; Utusan Malaysia, a Malay newspaper company and the concern of UMNO supreme council of the oldest Malay newspaper might be close has been taken care off. The merger would get Economic of Scale in economic term.

The only concern is worker might become complacent as they do not have close competitors now even they is still Harakah around.

Technology

Unlike chinese language. Which face higher technology problem on input data into computer and printing machine. Malay language, which used alphabet like English, face less problem in developing input and printing technology. The merger has less impact technologically.

Update: The Edge: Cross fire

A kadir Jasin: Implikasi Penggabungan NST-Utusan

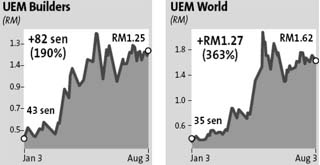

Utusan, NSTP surge on possible merger news

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse Media Newspaper