Adsense Top

Wednesday, May 24, 2006

Entrepreneur or Investor?

Last Thursday, Hong Leong and its Executive Chairman, Billionaire Tan Sri Quek Leng Chan is leading the disposal of global air-conditioning manufacturer, OYL Industries Bhd, to Japan's Daikin Industries Ltd in a cash deal worth a whopping RM7.61 billion.

This followed months of market talk that OYL might sell off its air-conditioning business or merge it with another multinational corporation.

HONG Leong Group Malaysia will receive a huge net cash inflow from the proceeds of RM3.04bil, having bought OYL very cheaply 16 years ago.

While the group had to subscribe to a large rights issue when OYL bought the US-based McQuay group in 1994, most of that cost would have been recovered from the dividends paid by OYL over the years.

The Edge's journalist Maryann Tan commented that : Perhaps no one applies the buy-low-sell-high principle better than Tan Sri Quek Leng Chan. The Edge further speculated that reported that Quek will pour money into BIL International. A company in gaming and leisure industry.

It's really disappointed that another entrepreneur I respect in Malaysia exist manufacturing business and pour money into leisure business.

While most reader of my blog might have gain some money in the takeover. It is really debatable whether Tan Sri Quek is an entrepreneur or an investor. While he is skillful investor in applying buy-low-sell-high strategy. Unlike Samsung's founder in South Korea, he never grow the company like Samsung.

However, there are a lot of entrepreneur like Matsushita in Japan make huge loss when he fail to exist Mainframe computer market that dominance by IBM at that point of time. South Korea's Daewo even become bankrupt when he unable to foreseen that his company unable to compete in automobile industries.

Thus, it really debatable whether Quek is an entrepreneur or an investor. The sad things is Malaysian loss a good company to Japanese. However, when the price reach billion. There are few Malaysian that able to swallow this huge company. After the disposal, all value chain in Eletrical and Electronic industriesin Malaysia has been dominated by multinational.

Electrical Appliance----->Semiconductor------>Computer

Panasonic/Daikin-------->Intel(MPI?)-------->Dell(Ftec?)

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

Background

OYL's operating margins have been on the decline on high raw material prices and stiff competition in the global market.

Its most recent quarterly results show earnings margins were down 3% despite a sharp 22% drop in prices of cold rolled steel coils, which accounted for 40% of its operating costs. Surging copper prices in recent months are likely to put more pressure on margins.

The Star reported that there is intense global competition, in particular, from South Korean consumer electronics groups. It is believed that The Star refer to South Korea's LG Electronic, which is competitive in air-conditioner market rather than Samsung, which strength is in Handphone and Audio visual product.

Speaking at a press conference to announce the acquisition, Daikin senior executive officer for global operations and board director Katsuhiko Takagi said the merged entity will have the second largest market share in the global air-conditioner business based on its combined sales of US$9 billion (RM32.44 billion) out of a total of US$60 billion, and he would be targeting for the company, in time, to be the world's largest. Currently, the world's largest is the US-based Carrier group.

The Hong Leong group is reaping the reward for having created value in OYL through McQuay. The American company was bought at a time when it was incurring losses due to its junk bond debts, which were progressively paid off when it was under OYL.

Critics noted that McQuay operated under thin profit margins on its huge sales in the United States and Europe. However, it was McQuay's technologies in air-conditioning that enabled the group to pursue a highly profitable expansion into China, other analysts said.

OYL's McQuay is the world's number four in large-scale commercial air-conditioning and AAF is world number three in air filtration products. OYL has a solid presence in China and the US, and Daikin has a leading position in Japan and Europe. Combined, we can significantly increase our global presence. Said Daikin senior executive officer (global operations) Katsuhiko Takagi.

AmResearch said OYL could derive benefits from being part of the Daikin family as it planned to expand air-conditioning operations into North America, India, Russia and Brazil.

Daikin said it was strong in products and technologies in the ductless air-conditioning segment, especially in high value-added air-conditioning, while OYL was strong in Applied business segment, and low-cost heating, ventilation, and air-conditioning products, with its low-cost mass-production technology.

Friday, April 28, 2006

Stupid Singaporeans and Li Ao

Taiwanese are scoundrels, but lovable, Hong Kong people are craftier, (Chinese mainlanders are unfathomable) and Singaporeans are stupider,?he said, adding that it is partially due to genetics. The original migrants who came here from China were of poor stock?

"Predictably, Singaporeans have reacted angrily to the terms stupid and poor genes, dismissing them as a popularity stunt that takes no account of their successful, modern achievements. This genetic weakness doesn't aptly describe todays diverse, more mature and worldly-wise generation. " write Seah Chiang Nee, a columnist at The Star base in Singapore.

However, Singapore, usually rank higher than Taiwan in world Competitive ranking; It is one of the lowest crime rate, lowest corruption rate in the world. Li Ao, a historian and a writer in Taiwan who used to oppose Chiang family (First & Second President) and ruling party Kuo Min Tang in Taiwan was view as a hero in Taiwan especially among ladies.

Although he is just a writer, he do not lack of sex partner and he marriaged to an actress before. He reveal all his sex relation and romantic affairs in his autobiography. This really unethic as majority of his ex-girl friend has marriage with husband and children. This has create difficulties to his ex-girl friend and their family.

He pround of his ability to attract ladies. Once he mentioned that a person who pass exam in ancient China to become a high ranking official or a Minister of emperor in China. His wife heard the news was happy initially. However jeoleous family member who husband unable to pass such exam told her that emperor would chop off his husband cock in order to become high ranking official and Minister. When the person back home, his wife look worried and not happy. The man confused and ask his wife why she is not happy when he able to become a Minister. The wife reply that she do not wish her husband become Minister but without cock. The husband said no such thing and show his cock to his wife. The wife become happy and laugh eventually when she saw her husband cock still remain intact. The man said that why my wife is not happy even I become a Minister. Sex satisfaction is more important than become Minister. It is not sure Li Ao get this story via history study (He is historian) or he try to use this story to show off to all the ruling party Minister to imply that he is more happy even he is not a high ranking official and a Minister.

In recent trip to Singapore to clarifiedarrified his "Stupid" remark to Singaporean. He praise Lee Kuan Yew to lead Singaapore to achieved present status.

Some commentator claim that if Li Ao live in Singapore. Judging from how Lee Kuan Yew treated his opposition. What is the fate of Li Ao is yet to be determine.

Li Ao, after release from jail, still able to join politic and become independent legislator in Taiwan. He also try to become Taiwan President in one of the previous election. He also become a host in Phoenixt TV station in Taiwan. His program able to view at Astro in Malaysia.

TechnoratiTag: Business Commentary Malaysia Opinion News and politics Politik

Tuesday, April 25, 2006

Scenic bridge - Gainer and loser

Gainer

1 Link Kedua Sdn Bhd - Operator of Second Crossing between Malaysia and Singapore. The second link still have extra capacity and under utilize. If the causeway has been demolished. traffic in second link will increase. Link Kedua might able to increase it toll rate to boost traffic. However, recent fuel hike received unwelcome response from people. This might be one of the reason government do not wish to proceed with Scenic Bridge.

2 Gerbang Perdana Sdn Bhd - Whether the government would like to proceed to build the Scenic bridge or not Gerbang Perdana Sdn Bhd would gain from it. It the government proceed with the project. As a concession holder of the Scenic Bridge, Gerbang Perdana would be the main beneficiary. It get compensation if government do not wish to proceed with the project.

3 Johor Port and Port of Tanjung Pelepas - Both port control by bumiputra tycoon Tan Sri Syed Moktar. If Malaysia able to demolish the causeway and replace by a bridge. This would enhance the competitiveness of both port against Singapore. Syed Moktar also control 20% of Gerbang Perdana via DRB-Hicom group.

Loser

1 People from both country - People from both country will be subjected to higher toll rate once the causeway is being demolished.

2 Transporter - transporter, who is major user of the causeway and second link. Would have to pay higher toll rate.

3 Tax payer - Tax payer become loser especially government have to pay enormous compensation to Gerbang Perdana.

4 Port Authority of Singapore - Malaysia port become more competitive and this will eaten Singapore's market shares in port management.

Conclusion

1 Singapore's people and it port authority become the main loser if government proceed with Scenic Bridge. Thus, Singapore do not want the bridge and Malaysia need the bridge more than Singapore. But Malaysia government fail to used a win-win approach in negotiation with Singapore, therefore, the negotiation fail. Singapore lose nothing if negotiation fail.

2 Users of the two crossing will subject to higher toll rate if government proceed to build the bridge. Thus, people should not upset over the cancellation. Only government would upset on it fail negotiation.

Updated Link : Global Voice Online

My Apple Menu: Singapore Surf

TechnoratiTag: Business Commentary Economics Economy Malaysia Opinion

Wednesday, April 12, 2006

Shares price hit record high! What's next?

Then property counter become another theme play by punter.

The question is: what happen next?

If you recall 1993 stock market bull run when the stock market is going up. The direct beneficiary is stockbroking firm and restaurant.

When stock trading volume goes up. The main beneficiaries are stock broking industry as their brokerage income would increase. Other profession like engineer would resigned to become a remisier. The only landscape difference is now the commission rate can be negotiated to substantially lower than in 1993. In 1993, commission rate is fixed at 1% of the transaction value but now commission can be as low as 0.3%, A 70% drop.

Punter might remember that in 1993, a stockbroking house market value can be as high as a commercial bank. At that point of time, we do not have universal broker. Now, a stockbroking company can become Investment Banker to collect deposit even brokerage margin has substantially lower. I do not understand why the outgoing Southern Bank Berhad substantial shareholder never negotiate to buy back it stock broking arm and Merchant Bank to form an Investment Bank. CIMB, which itself a leading Merchant Bank and it stockbroking arm a leading institutional trader, do not required Southern Bank Bhd's stockbroking arm and merchant bank. This is a poor exits strategy advised by a foreign adviser.

Another landscape different is now punter can directly buy a counter call Bursa Malaysia rather than punt on individual stock broking firm. If they unable to pick a counter. However, Bursa Malaysia shares price has rise substantially compare with stockbroking company.

If you see punter and retailer earning substantial money from the stock market. They will take their lunch in expensive restaurant and eat something like shark fin on a daily basis. You would find you unable to get a place in such restaurant during lunch time. Thus, I feel TT Resources Bhd is a good bet if stock market continues to rise.

TT Resources Bhd own Tai Thong Restaurant, It also own bridal houses. Other business included : Gloria Jeans Coffee and San Francisco Stake house.

Update: Brokers to gain from big turnover

Brokers are holding large stash of cash

Link: Investment Advisor

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

Monday, April 10, 2006

Pensonic enter water filtration business

Pensonic is one of the listed Malaysian electrical home appliance company. Other Malaysian electrical home appliance company that listed on the stock exchange including, multinational Panasonic (Formerly known as Matsushita), air-conditional specialist OYL, manufacturer Khind, trader Pensonic which market product under the same brand and Fiamma Holding Bhd that have numerous brand that including Elba and MEC etc, and I Bhd . Of course, we have other numerous OEM manufacturer that list on the stock exchange. Such OEM manufacturer manufacture for numerous MNC brand but they do not have their own Malaysia brand.

Other than multinational Panasonic, Malaysia most competitive electrical home appliance industry is air-conditional manufacturer OYL as Malaysia is the largest air-conditional exporter in the world. Another Malaysia company that able to compete worldwide is Uchi Technologies Bhd, the company manufacture electronic coffee makers.

With the electrical home appliance slowly dominated by China's low cost manufacture goods. Malaysian company is difficult to become competitive in TV and audio market. Market rumors said that even air-conditional manufacturer OYL was up for sales. Thus, the only way to survive to compete with China low cost manufacturer is like how US and Europe company compete with Japanese a decade ago...... Venture into health care equipment like GE in US and Phillips in Europe.

Pensonic recent venture into water filter and purified system signified a good move by Malaysia electrical home appliance manufacturer. Earlier, Uchi Technologies Bhd also has announced boosting of biotechnology business.

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

Friday, April 07, 2006

Negligent by Proton's directors?

How can a director of the company treated a deal amounting to RM367.6 million that likely that they do not aware of there is a veto power imposed by minority of MV Agusta. Apparently they are negligent in performing their duty as a director and should tender resignation as director of the company.

Actually, such material event should be disclosed to all minority shareholder of Proton before the deal go through. Not disclosed only after the company has disposed off the shares at controversy 1 Euro. However, Proton has stated under clause 3.2 on Proton statement on the disposal of interest in MV Agusta Motors SpA that :

In so far as the regulatory obligations of a public listed company are concerned, Proton has complied with all necessary requirements of Bursa Malaysia. However, addressing the matter publicly was not an option until now, as the agreement to dispose of the interest in MVAM was conditional and restricted the ability of Proton to fully address the uninformed speculation in the public domain.

In addition, it was also felt that responding to the allegations prematurely would have detracted from the main issue at hand, which was to resolve the MVAM issue and avert the potential liability. All this is part of acting in the best interest of the shareholders.

Minority watchdog, can you accept such explanation?

Even minority watchdog willing to accept such explanation. Can directors just claim that they are not aware there is a veto power on a deal that amounting to million and disclaim responsibility. It look like any person walking on the street is more brilliant and competent than Proton's director. What is the point of Company Commission of Malaysia or Suruhanjaya Syarikat Malaysia (SSM) required directors to attend course but director need not resigned from their position after a negligent has occur?

Other that the veto power. The founder of MV Agusta also has an anti-dilution clauses that protect the founder's interest. This was not disclosed to minority shareholder of at the time of acquiring MV Agusta. Only disclosed to the public on 28 March 2006 after disposed off the investment at controversy one Euro.

No disclosure make to minority shareholder when Proton exposure to bankruptcy risk cause by unique legal framework of Italy, where debt of subsidiary MV Agusta can cause a holding company Proton bankrupt.

Of course, Proton advisor Tun Dr Mahathir Mohamad is not convinced on the explanation.

However, can we just close off the issue like this?

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

Thursday, April 06, 2006

DiGi shares price hit RM9.30

One reader who unable to keep a job in research houses stated that smart investor should not follow analyst recommendations.

Now, in less than 4 months, those who act on such report has make money. DiGi hit RM9.30 at 9.45am today.

While I don't think I am a smart investor. However, it is undeniable that I am an investor that make money. Ahem!

Earlier, DiGi fail to secure 3G spectrum license from Malaysia government. However, technology columnist Oon Yeoh has commented that "Not getting 3G blessing for DiGi".

Update: DiGi closed at RM9.45 today

DiGi at 6-year high on capital repayment plan

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

Wednesday, April 05, 2006

Likely Hyundai of Malaysia

Base on Hyundai industrial cycle. Hyundai have started from a transport company, a motor vehicle workshop and then Construction, then shipbuilding, then automobile summary as follow:

Construction----->Shipbuilding------>Automobile

South Korea company able to transform a construction engineering company into a shipbuilding company. From knowledge gain from shipbuilding, they able to build car! A Korea's national car!

The only public listed company that fulfill the above industrial cycle is Muhibbah engineering (M) Bhd.

Source said that Muhibbah Engineering (M) Bhd was founded by previous founder and management of Nam Fatt Corporation Berhad. Thus, was not new to engineering and construction industry. The company venture into crane industry via Favelle Favco Berhad The company is in the process of listing Favelle Favco Berhad to Bursa Malaysia at the moment.

The company venture into shipbuilding industry via Muhibbah Marine Engineering (Deutschland) GmbH. Thus, Muhibbah industrial cycle is most similar to Hyundai:

Construction-------> Shipbuilding------->?

Hyundai has operate a car workshop at the initial stage to gain knowledge in automobile industry. This look like Boon Siew of Oriental at the beginning. Boon Siew start to work in a transport company to gain engineering knowledge before he get Honda franchise in Malaysia. However, Boon Siew and Oriental never venture into construction indsutry after that.

Muhibbah start from a construction company, then diversified to shipbuiding, despite not similar to Boon Siew of Oriental and Hyundai. Muhibbah has experience in crane industrial via Favelle Favco Berhad. They have an airline support industry as well. Thus, Muhibbah Engineering definately has technical capability to venture into automobile industry in future, this make Muhibbah a mini Hyundai in Malaysia.

TechnoratiTag:Business Commentary Economics Economy Malaysia News and politics Opinion Politik Shares Stock Market klse

Monday, March 20, 2006

Tenaga KPI too focus on financial performance

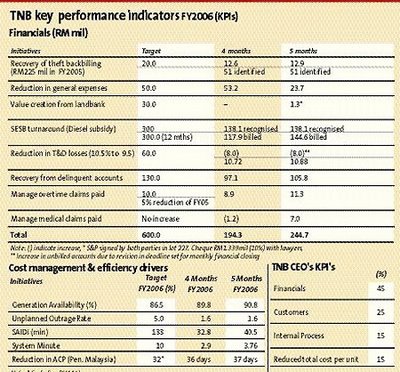

The Star bizweek interview of Tenaga chief Datuk Che Khalib Mohamad Noh reveal Tenaga's Key Performance Indicators (KPI)

Majority of the KPI reveal by CEO are mainly in financial term : recovery of debt, reduction in general expenses, value creation from land bank, SESB turnaround, recovery from delinquent accounts, average collection period, return on asset, procurement process time.

undeniable, he also reveal some technical KPIs like generation availability and productivity KPI like staff response time and number of kilowatt or megawatt produced per staff.

Datuk Che Khalid further reveal that for Senior Management. They have four quadrants of KPIs: Financials (45%), customers (25%), internal process (15%), and reduced total cost per unit (15%).

Based on the four quadrants. Does it balance?

With Financial cover 45%. It is hardly for me to said it is balance. Further, it is debatable whether reduced total cost per unit (15%) should be under Financial (45+15=65%) or Internal Process (15+15=30%)

Che Khalid is correct by mentioning that "we need the customer more than the customer needs us. Everything else will fall into place. If you take really good care of the customer than they will be willing to pay more for your really good service."

However, customers cover 25% is reasonable. However, Che Khalid never reveal what comprise customer KPI. It should included number of complaint received, number of compliment letter received or published on newspaper. Customer waiting time. Tenaga should follow EPF and Public Bank Bhd in reducing customer waiting time.

I feel that Financial should reduced to 25% to 30%.

One thing left out from the Balanced Scorecard system is Innovation. There is no KPI in Innovation. Like new method to read meter, new method to collect bill etc.

Too focus on financial KPI lead to management take an easy way out : tariff hike. More emphasis should be place on Customer, Internal Process and Innovation.

Instead, Tenaga should do what Che Khalid mentioned Take good care of the customer by tariff reduction to induced Foreign Direct Investment (FDI). Then Tenaga revenue would improved if a lot of foreigner set up factory here. Of course, they should minimise black out and other customer issue. Thus, I feel Customer KPI is more important.

TechnoratiTag:Business Commentary Economics Economy Malaysia News and politics Opinion Politik Shares Stock Market klse

Contradict reveal by Tenaga's chief and Energy Minister

Last Saturday, On The Star's Bizweek Cover feature on Tenaga National Bhd. TNB chief Datuk Che Khalib Mohamad Noh stated that : “We have already reached a critical level for survival ... For the last three years, we have been surviving on borrowed money,” Toss in an annual capital expenditure requirement of close to RM5bil, hefty debts of about RM30bil, and rising coal prices, and the push for a tariff restructuring becomes more compelling.

TNB Chief Datuk Che Khalid added in the interview by The Star : "At the moment, we have reached a level where every month, we are borrowing money to keep the company afloat because the total revenue that we collect is not even enough to cover the capex and servicing of debts. That's our situation today. "

On Sunday, Sin Chew Daily reported that Energy ,Water ancommunicationon Minister Datuk Seri Lim Keng Yaik Independent Power Producer (IPP) have 40% excess capacity of which the idealing cost has to babsorbeded by Tenaga. As there is 40% excess capacity of idealing power, there will be no new IPP in the next 10 years.

Thus, there is a contradict statement. If there is a 40% excess capacity, why is inecessaryry for further capital expenditure (CAPEX). Which TNB chief claim unable to cover by it revenue and stated as a reason for tariff hike. They should be no more CAPEX in the next 10 years as TNB has excess capacity.

For my knowledge, I only know there is only two possibility of CAPEX. One is for capacitexpansionon and the other is for replacement of existinassetsts.

If you have simple accounting knowledge. You would know that CAPEX on replacement of old machine should have been cover by it profit if TNB has depreciated iassetsts as required by accounting standards and the company make profit.

Based on Energy, Water and Communication Minister statement. CAPEX on capacity expansion is not required as it 40% excess capacity.

Even if TNB required expansion. Majority of the company used borrowing for capacity expansion. As a power analyst stated on The Star's bizweek that " “Utilities all over the world carry huge debts. For TNB, the option of refinancing its debts is available and this it has done and can continue to do, even if its debts are lumpy. TNB’s loans are sovereign guaranteed which significantly lowers its cost of borrowing. So that’s not so much of an issue to me.”

Thus, they is no basis for TNB tariff hike. Clearly, the purpose of tariff hike is for increase in shares price and gain on stock option by Tmanagementagment.

Either TNB chief or the Minister is wrong. Both of them own us an explanation. I do not oppose government recent fuel increase. However, I strongly opposed a tariff hike by TNB. My reader know that actually I hope TNB can be delisted from Bursa Malaysia.

TechnoratiTag:Business Commentary Economics Economy Malaysia News and politics Opinion Politik Shares Stock Market klse

Thursday, March 16, 2006

Would SBB become another Park May?

The Star Business Section also carried similar head lines .

After the acceptance. Southern Bank Berhad will be eliminated like Ban Hin Lee Bank, whereas Bumiputra-Commerce Bank will have more branch.

The Star commented that Merger will fit into BCHB scheme of things. It further reported that Three SBB members invited to boards of BCHB firms .

Obviously, for business community, loan from Bumiputra-Commerce Bank is much more easy than to get a loan from Southern Bank Berhad. However, in a time where Bank Negara Malaysia implement Deposit Insurance System and would not rescue any bank that collapse. A depositor in Southern Bank Berhad feel more secure to deposit money in SBB than in Bumiputra-Commerce, as Bank Bumiputra have a few record of unable to survive in recession.

CIMB have to borrow RM4 billion to acquired Southern Bank Berhad! Does this make the merged entity more stable financially?

A good managed public transport company Park May has been taken over by UEM Group 10 years ago to "restructure" the public transport system in Klang Valley. UEM group has to borrow to finance the acquisition and whereas Park May borrowed money to replace all old buses with new buses. Price hike immediately announced after the takeover. Bus fare has increase few time after that but Park May still in huge loss. Bus service become less frequent as the company try to cut cost by reducing the trip, but this also unable to save the company.

Eventually, government has to come in to to bail out Park May from UEM group and Intra-Kota from DRB-Hicom Group.

Now, Bumiputra-Commerce Bank choose to acquire and eliminated a good managed bank rather than a bank with more Non-performing loan(NPL) like Affin Bank. This is like a Park May take over that eliminate good managment from a good running company.

As a banker, CIMB group should know that using gearing to acquire another company is a risky move. Malaysian really pray that the merged BCB-SBB would not become another Park May. As government now do not have financial strength to bail out a fail company. A merged large group also difficult for government to swallow financially. Government should try every effort to prevent such thing happen as the bank might be acquired by foreigner after the liberalisation in banking industry if such incident occur.

Ex-shareholder of Park May. After spending many year of building up the company have force to dispose off and leave the company. They are happy now as they keep a huge money now paid by the acquirer. However, public and the consumer has to suffer as there do not have the service of such a experience and good managed operators.

Of course, like Park May, this unlikely to happen in next 6 years. However, according to history of Bank Bumiputra, to survive another 12 year is a real test.

Hope the management of Bumiputra-Commerce Bank would not make the SBB shareholder laughed after 12 years!!!

Updated: dinzlink.net:BCB+SBB=CIMB?

smallandmedium.blogspot.com : southern bank another one bites dust

TechnoratiTag:Business Commentary Economics Economy Malaysia News and politics Opinion Politik Shares Stock Market

Wednesday, March 15, 2006

Does UEM shares price bull run sustainable?

Within one week of my blog post on UEM bull run. Share prices of companies under the UEM group attracted strong buying interest on Monday. Nanyang Daily also reported that there is a rumours in the market said that the government might take UEM World private.

However, the question is whether the shares price bull run is sustainable? Sustainability of shares price, of course will depend on whether the rumour on Ninth Malaysian Plan is truth.

One of my friend told me that during 1993 stock market bull run. He punt share counter of Renong and UEM. He start with very low capital....less than RM1,000. He play rotationally just two counter for the whole 1993. For a tiny RM1,000, he able to accumulated more than RM1 million. However, the RM1,000,000 he make during 1993 stock market bull run slowly depleted between 1994 to 1997 and has been completely wipe out after Asian financial crisis around 1998.

If he stop punting in the stock market after 1993. He must able to keep his wealth.

If market rumuor on Ninth Malaysian plan is truth, and you find it difficult to invest in stock market as you do not know which counter to buy, or you have difficulties in prediction of next concept play. You can just focus on two counter and play it rotationally. Would history repeated itself is any body guess?

TechnoratiTag:Business Commentary Economics Economy Malaysia Opinion Shares Stock Market

Tuesday, March 07, 2006

The beginning of next UEM bull run

The first prong of the plan, with the largest federal government allocation of RM6 billion, will develop vast areas between the two existing links to Singapore. Included in these plans are the developments of the Bandar Nusajaya township and the waterfront city of Danga Bay, a development owned by Ekovest.

Shares price of Ekovest Bhd has improved marginally on Monday.

The south Johor development will be complemented by the "bullet train" project from Kuala Lumpur to Johor. This proposal was initially believed to have been mooted by the YTL Group. However, it is understood that Khazanah may lead this project.

Another facet of the 9MP will be the construction of the long-awaited second Penang Bridge. While the second bridge will fall under the 9MP, it will eventually become part of plans to develop the Northern Corridor

Sources say other than the direct beneficiaries such as Ekovest, the other possible winners in the 9MP would be those government-linked companies such as the UEM Group. UEM, almost 100% owned by Khazanah, will most likely lead the development of the bullet train and parts of the SJDA project.

Of course, the Bandar Nusajaya township is already owned by UEM subsidiary Bandar Nusajaya Sdn Bhd (formerly known as Prolink Development Sdn Bhd). Bandar Nusajaya is the ambitious township development in Gelang Patah, near Johor Baru, adjacent to the second link between Singapore and Malaysia launched in the heyday of the 1990s.

A key player in the Southern Corridor could also be Tan Sri Syed Mokhtar Al-Bukhary who controls the Port of Tanjung Pelepas, Johor Port and also Senai Airport.

Another UEM subsidiary, UEM Builders Bhd (formerly known as Intria Bhd), already owns the existing Penang Bridge. UEM Builders also has some experience in the construction of railways — admittedly a somewhat less salubrious experience.

The Edge further reported that Syarikat Prasarana Negara Bhd (SPNB) will extend the Putra and Star LRT (light rail transits) lines as well as construct a new line.

Shares price of UEM Builders Bhd has improve marginally on Monday. However, shares price of it holding company UEM World Bhd remain stagnant. UEM world Bhd, which also control CEMENT Industries of Malaysia Bhd (CIMA). CIMA shares price has rise to 3 year high .

Thus, it just a matter of time for UEM World Bhd shares price to rise.

Punter would remember how Renong (Now UEM World) and UEM ( Now UEM Builder) shares price increase from a few sen to more than Ten Ringgit in 1993 stock market bull run. While Malaysia stock market was one year behind the regional stock market. It is just the beginning of another bull run for UEM group of company. A once in 13 years opportunity you unable to miss.

Update:Ninth Malaysia Plan to revive construction

Analysts’ pick of gainers

Interest ahead of 9MP-Ekovest

TechnoratiTag:Business Commentary Economics Economy Malaysia Opinion Shares Stock Market

Wednesday, March 01, 2006

Which timber company on Bursa Malaysia affected by Pahang's timber freeze?

Today, 1 March 2006, Nanyang Siang Pao further reported that all timber sawn factory in west Pahang will run out of raw material and have to cease operation next week. More than 10 thousand people has been affected by the freeze including timber logging company, timber sawn miller factory, transporter, foreign factory worker etc. More than 10 thousand people became jobless because of the freeze.

Timber logging company from other state capitalize on the situation by charging higher price on timber log. However, this is on a willing buyer and willing seller basis.

A few sawn timber factory in the Pahang state have to cease operation today while the other are expected to cease operation next week.

Which listed company on Bursa Malaysia affected by the freeze? Pahang State Development Corporation only hold two public listed company: Pasdec Holding Berhad and Far East Holding Berhad, property development company and plantation company. No sawn timber company. No wonder the state government not hesitate on the freeze.

Timber log company from other state will be a gainer as there able to charge supernormal price. You might able to make some money if you able to guess one.

Link: The Star

Update: Pahang lifts logging freeze

TechnoratiTag:Business Commentary Economics Economy Malaysia News and politics Opinion Politik Shares Stock Market

Tuesday, February 28, 2006

Please keep OYL within Malaysia

If OYL fall in the hand of foreigner like Matsushita. It would be a great loss to Malaysia industry. It does not appear that Hong Leong Group nor Tan Sri Quek Leng Chan required the money. No apparent politic pressure to dispose off the company like what happen to Hong Leong few years ago where it force to dispose off it print media arm Nanyang to Huaren Holdings. I really hope that Hong Leong would keep the company for national interest.

In the event that Hong Leong want to dispose off the company. I really hope it dispose it to a Malaysia's company than to a foreigner like Matsushita. It is a social responsibility for Malaysian entrepreneur to keep the company within Malaysia.

In the latest announcement by OYL in replied of query from Bursa Malaysia. OYL stated that:

O.Y.L. Industries Bhd ("OYL") informs that, from time to time, it has received approaches from various parties to explore business propositions. Currently, OYL is in discussion with a party (not Matsushita) who has expressed interest to purchase OYL but it has not led to an offer being made so far. The discussion may or may not lead to a definitive agreement. If a definitive agreement is reached, an appropriate announcement will be made.This announcement is dated 28 February 2006.

Oh, I hope the offer is not cause by my blog post!

Link : Nanyang

TechnoratiTag:Business Commentary competitive Economics Economy Malaysia News and politics Opinion Politik Shares Stock Market

Monday, February 20, 2006

CNI unable to achieve revenue target

Main board listed direct selling company CNI was not expected to achieve its forecast revenue of RM317mil for financial year 2005. Reported The Star on 18 February 2006.

According to Executive Director Sam Cheon(pic), external factors such as rising oil prices and weaker buying sentiment dampen the company’s profits.

“Last year was very challenging for the industry and CNI,” Cheong said

This proved my analysis published on another blog BeautyBiotech.blogspot.com is correct.

TechnoratiTag: Business Commentary Malaysia Opinion finance Shares Stock Market

Sunday, February 19, 2006

Shares price of I-Power rises to record high

Shares price of I-Power Bhd, which feature by this blog on 15 January 2006 and by The Star on 16 February 2006 has surge to record high.

Another company that feature by this blog on 15 January 2005 is Online One Bhd. It shares price has rise to record high much earlier on 6 February 2006. However, if you never sold on 6 February 2006. Too bad. It share price has drop back to it normal level.

Similarly, shares price of Kannaltec also rise to record high on 15 February 2006. It has decrease from it record high but you still able to make a profit if you disposed off now. However, one of the mainstream chinese newspaper in Malaysia recently reported that Kannaltec has high cash in hand per shares compare to it shares price. I unable to retrieve that particular article now but will update you soon.

Update: Strong performance & cash flow, Kammaltec shares price under value

Excerpt translation: Kannaltec's have 0.12 cash in hand per shares. which is higher than it current share prices. It has total cash in hand of more than RM14 million

TechnoratiTag: Business Commentary Malaysia Opinion finance Shares Stock Market

Wednesday, February 15, 2006

My analysis on cabinet reshuffle 1

Gerakan loss Deputy Internal Security Minister to MCA. Gerakan's Internal security Minister Chia Kwang Chye has been transfer as Deputy Information Minister. Whereas MCA's Deputy Higher Education Minister Datuk Fu Ah Kiow is now Deputy Internal Security Minister.

This cause MCA effective change Information Ministry portfolio with Gerakan's Internal Security Ministry portfolio. A gain to MCA and a loss to Gerakan as Internal Security Ministry, which control police and media, which is much more powerful than Information Ministry, which only control media.

Additionally, MCA also has one more portfolio. Deputy Information Minister Donald Lim has been transfer as Deputy Tourism Minister. Whereas, total portfolio control my Gerakan remain unchanged.

UMNO Deputy Internal Security Minister Datuk Noh Omar has been made Deputy Education Minister. Datuk Noh Omar was said to be the person follow Pak Lah instruction to against corruption. However, he recent poor skill in handling relation with China by asking foreigner to go home if they find the Malaysia Police cruel and blame media misquote him has cause him transfer to Education Ministry. May be corruption fighting has to be start from child via education!

2) Nazri responsibility increase. A promotion?

Minister in the Prime Minister Department Datuk Seri Mohd Nazri Abdul Razak responsibility has been expand to cover Datuk Seri Radzi Sheikh Ahmad portfolio after the later transfer as Home Minister.

Nazri did a good job as a Chairman of The Human Right Caucus.

Home Minister Datuk Seri Azmi Khalid, who said poorly handle the repatriations of Indonesian illegal worker which cause a mini recession has been transfer as Natural Resources and environment Minister. Azmi gear up with the new portfolio as he claim he is an environmentalists. In fact he should be happy as he able to remain as Minister. Two Minister that fail to elected as central committee of UMNO. Higher Education Minister Datuk Seri Shafie Mohd has been dropped whereas Tourism Minister Datuk Seri Abdul Kadir Sheikh Fadzir resigned.

The dropped of Shafie as Higher Education Minister might be cause by the drop of University Malaya in Times Higher Education Supplement (THES) World University Rankings.

New Home Minister is UMNO Secretary General.

3 Rafidah remain as International Trade and Industry Minister

That might be the reason why the Prime Minister never reshuffle the cabinet after the WTO meeting in Hong Kong. It is difficult for a new Minister to catch up as the next WTO meeting will be held at March. This also indicated that Prime Minister still do not have succession plan for this portfolio.

4 Effenddi reappointed as Minister after selling NTV7 to UMNO's TV3

Businessman and ex-Agricultural Minister Datuk Seri Dr Effenddi Norwawi reappointed as Minister in the Prime Minister Department after he dispose off NTV7 to Media Prima, which control TV3 and a company control by UMNO.

Effenddi was helping the Prime Minister in Ninth Malaysia plan recently and he was replacing Datuk Mustapha Mohamed, who has transfer to Higher Education Ministry. Mustapha, a Minister train by ex-Finance Minister Tun Daim was having a taught job ahead to make university in Malaysia more competitive and climb in international ranking.

In my opinion,Effenddi actually qualified to become Finance Minister but he is not from UMNO and his last business venture in NTV7 unable to make profit.

5 Berjaya group well connected with Tengku Adnan

New Tourism Minister and ex-Minister in Prime Minister Department was closely associate with Berjaya Group and Tan Seri Vincent Tan. However, Anti Corruption Agency (ACA) has made a clearance for all new Minister to Prime Minister before he made anouncement of cabinet reshuffle.

TechnoratiTag: Commentary Malaysia News and politics Opinion Politik cabinet reshuffle Shares Stock Market

Friday, February 10, 2006

Fate of businessman turn politician

The recent case of controversial Thailand Prime Minister indicated that it is better for businessman to remain focus on it core competencies....business rather than enter into politic.

The first example of businessman turn politician in Malaysia is Tan Koon Swan. He founded Supreme Coporation and Multi-Purpose Group. He was elected as the President of Malaysia Chinese Association (MCA), second largest political party in Malaysia. However, he was involved in the Pan-El crisis in Singapore which cause the closure of Malaysia and Singapore stock exchange for consecutive 3 days, a first time in history in Singapore & Malaysia. He then sentence to jail in Singapore and later in Malaysia for criminal breach of trust. His family now control a small property company listed on Bursa Malaysia, Crimson.

The second is Joseph Chong of Westmout Industries Bhd which control Sabah Shipyard Bhd at one point of time. He was Secretary General of Gerakan and a Member of Parliament of Batu division. He has benchmark himself against Tan Koon Swan at one point of time. Who has amass wealth in business and get high ranking in politic. What an inauspicious benchmarking. He later persuade by rival of Gerakan President to challenge his mentor, President of Gerakan Tan Sri Lim Keng Yeik. He has to dispose off Westmout Industries Bhd after he loss in a contest as Gerakan President. However, he able to cash out before Asia financial crisis. Thus, I believe he still maintain some wealth.

Update: The third is Soh Chee Wen. Soh Chee Wen started as a distributor of a direct selling company or multilevel marketing company, and later founded his own direct selling company. He nearly went bankrupt when recession hit Malaysia. He later take over Lake View in Subang Jaya and successfully make a come back in corporate sector. He then take over numerous golf club and make a name in leisure industry. After 1993 stock market bull run in Malaysia. Soh Chee Wen have control numerous public listed companies. He then become MCA Petaling Jaya Division Head and MCA Selangor State Liaison Commitee Chairman. He held son of ex-MCA President Datuk Seri Ling Leong Sik to gain control of several public listed companies. Share price of public listed company control by Soh Chee Wen and son of Ling has depleted substantially. His relationship with Ling turn sour. Now, Soh still have court case with Security Commision and Ling. Ling's son , however, has become Deputy President f MCA 's Youth Division.

Bumiputra entrepreneur, Tun Daim Zainuddin exist corporate sector to serve government as Finance Minister of Malaysia. He transfer an officer who "disappear" during office hour to "minum teh" out of Finance Ministry after being told he unable to remove a civil servant. His Ministry quickly become as efficient as private sector after that incident. However, his private sector style was unpopular among civil servant and UMNO member. He was recently involve in a controversial court case.

The fate of the above four persons must be difference if they remain in business and distance themselves from politic.

In Korea, Hyundai founder also joint politic at the age of 70. His sons, however, was charge by government on corruption. He pass away with disappointment and unhappiness.

What is the fate of Thailand Prime Minister Thaksin Shinawatra is yet to be see!

Update: Thai PM defends record after five years in power

Update: Global Voice Online

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market

Wednesday, February 08, 2006

Tax benefit on brand building

It indicated that Malaysia's company unaware of tax incentive provided by Malaysia government on brand building.

Malaysia's government provide double tax relief on Advertising & Promotion expenses on Malaysian brand. It might not substantial at a glance. Based on Malaysia tax rate at 28%, double tax relief is 56%. This is more that half of the Advertising & Promotion Expenses you spend. Thus, this is a powerdful leverage strategy you unable to ignore.

If you never do any brand building but your competitor did. what is the difference? Let illustrated if a company have RM2 million profit per year.

Tax Paid 28% 560,000.00

Net Profit after Tax 1,440,000.00

From the above illustration. Company with brand building pay RM0 tax wheareas company without any brand building expenses have to pay RM560,000.00.

Although Profit after tax for company without brand building expenses more RM440,000 than company with brand building expenses. However, in real life practise. Company with brand building expenses might generate more sales and thus more profit than company without brand building. Thus, usually company with brand building have more after tax profit than company that without any brand building expenses.

In theory, every RM1,o00,000 spend on advertising equivalent to RM440,000 on advertising expenses only. As government subsidise RM560,000. I rather pay the advertising company rather than pay to government. Amount pay to adversing company generate more sales than paying tax to government which generate RM0 additional sales.

If both company do pay advertising expenses but one with Malaysian brand that entitle to double tax relief but the other company pay advertising expenses but not Malaysian brand like OYL.

Non Malaysian brand

Profit 2,000,000.00

Advertising & Promotion 1,000,000.00

Net Profit After A&P Expenses 1,000,000.00

Taxable Profit 1,000,000.00

Tax Paid 280,000.00

Profit After Tax 720,000.00

Malaysian brand

Profit 2,000,000.00

Advertising & Promotion 1,000,000.00

Net Profit After A&P Expenses 1,000,000.00

Taxable Profit 0.00

Tax Paid 0.00

Profit After Tax 1,000,000.00

There is another method of performance measurement call Economic Value Added Mehtod. Which Advertising and Promotion does not classified as expenses but classified as non-tangible assets. Thus, I strongly advise Malaysia company spend A&P on Malaysian brand to improve competitiveness of Malaysia company.

Technorati Tag: Business Commentary Economics Economy finance Malaysia Opinion

Sunday, February 05, 2006

Samsung of Malaysia, Hong Leong

I disagree with him and I feel Malaysia have a few company. We have IOI group which has just acquired some business from Dutch's Unilevel Group. We have YTL Corporation which supply water to resident in UK etc.

South Korea icon is Samsung. Samsung started from Brevery, sugar refinery, textile, paper pulp and packaging, electrical appliance, Semiconductor and handphone.

While Robert Kwok in Malaysia start from sugar refinery, like Samsung. He later invest his wealth in leisure industry and not manufacturing like Samsung.

In Malaysia, one company that venture into paper pulp and packaging, electrical appliance and semiconductor industry is Hong Leong Group in Malaysia.

Hong Leong group first involve in packaging business when it acquired Malaysia Pacific Industry Bhd (MPI). Base on profit from the packaging. The company diversified into semiconductor business and renamed MPI. MPI later demerged the pakaging business from MPI to become Guolene Packaging Industries Bhd. In late 2004, Hong Leong Industries Bhd sell it packaging business to San Miguel Corp, the Philippines’ largest publicly listed food and beverage company, for RM133 million cash.

MPI operate it semiconductor business under Carsem and Dynacraft Industries Sdn Bhd. Not MPI nor Hong Leong. Thus, I feel Malaysia do not lack of world class company. The problem is branding. They do not operate under a single brand.

Malaysia is the largest air conditional manufacturer and exporter in the world. The leading player is Hong Leong's OYL Industries Berhad.

OYL Industries Berhad's CEO Liu Wan Min has been listed as one of the 20 CEO we admire at the year end issue of The Edge in end of 2005, together with his boss, Tan Sri Quek Leng Chan.

In Malaysia, OYL market it air-conditional under Acson and US's York Brand since 1978. Not Hong Leong nor OYL. In the 1990s, OYL acquired US-based SnyderGeneral, now renamed McQuay. It is not sure why Hong Leong never renamed it Acson nor Hong Leong but McQuay?

Again, we do not lack of world class company but it is an issue of branding.

If Hong Leong able to merge OYL and MPI under one company. It significant in Bursa Malaysia might be same as Samsung in Korea. OYL market capitalization is larger than Proton, a automobile manufacturing company.

OYL is more like LG in Korea rather than Samsung as it comprise mainly air-conditional and refrigerators and do not have audio division.

In Semiconductor, MPI is doing turnkey pakaging ,test services and manufacturers of lead frames and microelectronic packaging systems. This is still consider the low end of the vlue chain in semiconductor industry compare with Samsung Semiconductor.

The most important is Hong Leong do not have hanphone division.

Clearly, Malaysia have a lot of catch up to do. However, Hong Leong have the foundation which make the catch up much more easy compare with other group. Government should provide incentive for such group to merge, to venture to audio division, to take over loss making government semiconductor manufacturing division and to venture to cell phone manufacturing.

Please be reminded that Samsung mobile does not become competitive base on protection by Korea government but it own achivement.

Blog that link here: Amateur Zen Trader

TechnoratiTag:Asia Business Commentary competitive Economics Economy Malaysia News and politics Opinion Politik Shares Stock Market

Thursday, February 02, 2006

Global Voice feature Chinese New Year In Malaysia

I unable to blog for the subject as this might reveal my identity. However, I discovered that Global Voices Online has cover the subject. Read it if you are interested.

Update : Miracle8

Sunday, January 22, 2006

Celebrating Chinese New Year.

Happy and prosperous Chinese New Year

10 Days Course : Guide To Trading With Discipline & Confidence (Advertorial)

TechnoratiTag:Business Commentary competitive Economics Economy Malaysia Opinion finance

Friday, January 20, 2006

Rumour on Digi & Telenor investment

Last few days, some of my reader has post comment on my blog to inform that there is a rumour in the market saying that DiGi minght not get the 3G license. Consumer in Malaysia will lose out if 3G license never grant to DiGi. The biggest beneficiary would be Government Link Company Celcom as it is less competitive compare to the other two telco.

Oriental Daily reported today that Energy, Water and Telecommunication Ministry want to standardize all telephone charges among the 3 telco. This mean consumer would not get the benefit of the price war rate they currently enjoy now. Again, the biggest loser is consumer and the biggest beneficiary is government control celcom. I feel government should let the market and each respective company to determine the price. Let the "invisible hand" to do the job rather than interference by the government.

Today, The Edge Daily reported that Telenor ASA, holding company of Digi Berhad announced that the company would invest RM45 million over the next three years to develop research and innovation (R&I) facility in Cyberjaya, the first outside Norway. This might be the reaction of Telenor against the rumour of DiGi not getting the 3G License. With so much money invest in cyberjaya. Would government reject the 3G license DiGi apply for?

It would be foolish for government to turn away such FDI in Multimedia Supercorridor (MSC)

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market technology

Wednesday, January 18, 2006

South Korea, Singapore, Hong Kong and Malaysia

The debate : Does South Korea really offer a better model of development for Malaysia than our neighboring Singapore.

Jeff Ooi is correct by pointing out that South Korea has relatively a vast population, while Singapore is a tiny red dot.

Thus, I feel it is difficult to compare South Korea with Singapore.

Comparison with Singapore : Hong Kong

People used to compare Singapore & Hong Kong. They have similar population and size and both are financial centre and their port is shipping hub in world trade.

Malaysia benchmark against Singapore?

Although constantly denied by the authority. I feel Jeff Ooi is correct that Malaysia government is benchmark against Singapore in term of government policy.

1) Merger of Bank

Singapore government has merge it country bank into 4 bank to ease control. It would be more easy for central bank to monitor 4 banks than say 20 banks. Thus, more easy work for central bank audit team. Similary, Malaysia has merge it bank to 10 anchor bank few years ago.

Hong Kong, however, is a free market. It never dictate how many bank the territory is needed. audit team do not have difficulties monitor the banking industry.

2) Dominate by Government Link Company (GLC)

Singapore Stock Exchange is dominance by GLC like Singapore Airline (SIA) and Singapore Telecom (SingTel). Malaysia, after Asia financial crisis, has change it policy from nurturing bumiputra entrepreneur to become operate as GLC. Like Renong Group, now UEM World and others.

Whereas Hong Kong do not lack of entrepreneurs like Li Ka-Shin etc.

Both of the above policy has cause the diminish of bumiputra entrepreneur. Whereas GLC has been excluded in calculating bumiputra ownership under New Economic Policy (NEP). The cause bumiputra unable to meet the 30% ownership under NEP objective. In fact, bumiputra might control more than 50% of Malaysia economy if GLC is classified as bumiputra.

Under government merger policy. All Express Bus company run by individual bumiputra has been merge to become a company call Konsortium Express Bus (KEBS). All mini bus license has been take back and give to one company call Intrakota. All Teksi license has been take back and issue to few teksi company.

In fact, transport business is less competitive business and it is an easy business to nurture entrepreneur especially bumiputra entrepreneur. By merging all entrepreneur under one company. It look like Malaysia has shift from Hong Kong policy to follow Singapore policy. Then how government going to nurture bumiputra entrepreneur to achieved NEP target.

Really, I don't understand why it call Ministry of entrepreneur Development as it never develop entrepreneur at all. It should call it old name: Public Enterprise Ministry!

I feel government need not re-implement New Economic Policy. Government can just change it policy by following Singapore policy to become a Hong Kong free entrepreneur policy.

In private sector, we do not lack entrepreneur that similar to South Korea entrepreneur. Robert Kwok, Malaysia Sugar King same with Samsung founder start with Sugar refinery. But Samsung invest the profit from sugar into manufacturing like electronic whereas Malaysia's Robert Kwok invest in Hotel industry.

Similarly, if you read Genting's founder Tan Sri Lim Goh Tong Biography, you would find he is like Hyundai founder who like to work in contruction site. Hyundai, like Samsung, invest their money in manufacuring, to be specific, automobile manufacturing. Whereas Genting group focus on hotel and casino again.

It is sad that Malaysia entrepreneur like invest in leisure industry. If they venture in manufacturing industry like their South Korea counterpart. Malaysia might have Chaebols as large as South Korea.

Related read : Benchmarking of Asia Country

Next : Samsung of Malaysia

Hyundai of Malaysia

TechnoratiTag:Asia Business Commentary competitive Economics Economy Malaysia News and politics Opinion Politik Shares Social

Tuesday, January 17, 2006

The battle between Thailand Prime Minister & media tycoon

Media tycoon Sondhi Limthongkul come to limelight when he launch a pan-Asian newspaper Asia Times in 1995 to rival Asia Wall Street Journal. He claim that Asia Wall Street Journal published western view point and Asia required it own paper to published Asia view point. His definition of Asia: excluding Japan and Korea, more narrow than Malaysia ex-Prime Minister Tun Mahathir definition of Asia which only excluding Australia and New Zealand. Asia Times went down in flames when the financial crisis erupted in 1997. One of Sondhi Limthougkul's monthly magazine Asia Inc has been taken over and run by by Malaysia's The Edge.

Sondhi Limthougkul said he only seeking freedom of speech so that newspaper control by him able to published news on abusing power, cronyism and corruption. But the reaction of Thanksin's government has force him to battle with the government to protect his own interest.

Thanksin has withdraw a legal action against Sondhi's newspaper under the advise of King.

Nanyang Siang Pao on 16 Jan 2006 commented that the battle is a conflict of business interest between family of Thanksin and Sondhi. Nanyang further commented that Thanksin ruling party won more than 80% of the parliament seat during election held on February last year make him the only Prime Minister to have two term in office in history of Thailand. Thus, Sondhi organized rally, despite reasonable, difficult to stand on legal ground.

Today's Nanyang reported that teacher in Thailand has joint the rally to protest the Prime Minister.

Update: Thai PM defends record after five years in power

TechnoratiTag:Asia Commentary Malaysia News and politics Opinion Politik

Monday, January 16, 2006

Republished of Dr Ng Seng's letter

TechnoratiTag: Malaysia Opinion finance News and politics Opinion Politik Shares Social