Forbes Asia has published a list of Malaysia's richest 40. The top 10 list are as follow:

1. Tan Sri Robert Kuok US$5.6b (RM20.55b) - 83

2. Tan Sri Ananda Krishnan US$4.6b (RM16.88b) - 68

3. Tan Sri Teh Hong Piow US$2.1b (RM7.71b) - 76

4. Tan Sri Lee Shin Cheng US$2.05b (RM7.52b) - 67

5. Tan Sri Quek Leng Chan US$2b (RM7.34b) - 65

6. Tan Sri Lim Goh Tong US$1.5b (RM5.51b) - 88

7. Tan Sri Yeoh Tiong Lay US$1.1b (RM4.01b) - 76

8. Tan Sri Tiong Hiew King US$1.05b (RM3.85b) - 70

9. Tan Sri Syed Mokhtar AlBukhary US$1b (RM3.67b) - 54

10. Tan Sri Lim Kok Thay US$440m (RM1.61b) - 54

Changes?

The most apparent changes of the list compare with previous year is Public Bank Berhad's Tan Sri Teh Hong Piow and IOI Group's Tan Sri Lee Shin Cheng overtake Hong Leong's Tan Sri Quek Leng Chan and Genting's Tan Sri Lim Goh Tong.

Quek Leng Chan and Lim Goh Tong used to be in the top 4 together with Robert Kuok and Maxis's Ananda Krishnan.

Tan Sri Teh Hong Piow and Tan Sri Lee Shin Cheng are first generation who create the wealth themselves and not involve in gaming industry like Lim Goh Tong and Ananda Krishnan. Robert Kuok and Quek Leng Chan are second generation. Which mean their father has earn the first million and they inherited some wealth from their father, while Ananda Krishnan and Lim Goh Tong involve in gaming industry which consider a money printing industry.

Industry

Public Bank Berhad's Teh Hong Piow is the only banker in the top 10 list. As Malaysia has a policy of no longer issue banking license to individual. Tan Sri Teh might be the last banker on the list (top 10 list, another bumiputra banker, AmBank Azman appear on top 40 list)

3 persons(2 family) are in gaming industry. Ananda Krishnan via Tanjong and Lim Goh Tong and Lim Kok Thay via Genting.

5 persons (4 family) (40-50%) are involve in power industry. Ananda Krishnan via Tanjong, Lim Goh Tong and Lim Kok Thay via Genting, Yeoh Tiong Lay via YTL Power and Syed Mokhtar AlBukhary via Malakoff. Thus it might be helpful if you involve in power generation or IPP if you want to be on the top 10 list.

That might be the reason why public and blogger are unhappy on IPP contract.

Next: IOI Group: Unilever of Malaysia?

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

Adsense Top

Friday, June 23, 2006

Tuesday, June 20, 2006

A warning to Tun Dr Mahathir

The outburst harsh criticism by former Prime Minister Tun Dr Mahathir Mohamad against his successor Datuk Seri Abdullah Ahmad Badawi has made the headline on all mainstream newspaper in earlier Jun 2006.

Datuk Seri Abdullah Ahmad Badawi has an upper hand so far:

1) On the day of the news of Tun Dr Mahathir Mohamad alleged Pak Lah cutting off major project initiated by him. On the same day, all Chinese newspaper in Malaysia carried a news report that a strategist of Bank of America praise Malaysia fiscal policy and express confident in Malaysia currency compare to its previously and with other third world country in their economic and business section.

2) Over the past week, Umno Members of Parliament, Mentris Besar and the Barisan Nasional component leaders have all pledged their support to Abdullah. The expression of support has been overwhelming and certainly his control of Umno is unshakeable. The Star's columnist Wong Chun Wai write " But even those close to Dr Mahathir acknowledge the reality that it makes no sense for ambitious Umno politicians to back this retired politician who has no plans and no hope of coming back to power. It is only politically wise to invest in the present and the future, if one wants to climb the hierarchy. "

On 14 June 2006, The Court of Appeal has quashed Sukma's conviction for allowing his adopted brother Datuk Seri Anwar Ibrahim to sodomise him eight years ago. Justices Gopal Sri Ram, Hashim Mohd Yusoff and James Foong unanimously allowed Sukma's appeal and set aside the conviction and six-month jail sentence. A coincident?

Sukma convicted when Tun Mathathir was in power. A retrial order clearly is an embarrassment to Tun Dr Mahathir. Is this just a coincident or a warning to Tun Dr Mahathir?

Clearly, when Pak Lah face difficulties in getting police to accept IPCMC. Whether right or wrong. Pak Lah cannot afford to lose this battle.

Influence of people with other agenda

Tun Dr Mathathir also said:

But the present government can do a good job if they want to. The means are there but if they come under the influence of people who have other agendas, then I can’t help.

Who is the influential people with other agenda?

On 14 June 2006 issue of Oriental Daily. Matthias Chang, the former political secretary of Tun Dr Mahathir Mohamad said Kalimullah Masheerul Hassan and Khairy Jamaluddin are the people who influence the PM, and challenge the two to debate with him.

Kalimullah is the New Straits Times Press deputy chairman and editorial adviser while Khairy is Abdullah's son-in-law of PM and Pemuda Umno deputy chief.

Both are directors of ECM Libra. Kalimullah is Executive Chairman and Co-Chief Executive Officer while Khairy is Director of Investment Banking in ECM Libra.

Clearly ECM Libra is the most influential merchant banker in Malaysia. At least it is like Phileo Allied Bank when Anwar Ibrahim was Finance Minister, if not more influential. ECM Libra is in the process of merger with Avenue Capital Resources Bhd.

The risk of investment in ECM Libra is they involve in political controversial like with Matthias Chang and a lot others. This is a great political risk you must excess before you put your money in.

TechnoratiTag: Commentary Malaysia Opinion Shares Stock Market klse News and politics Politik

Datuk Seri Abdullah Ahmad Badawi has an upper hand so far:

1) On the day of the news of Tun Dr Mahathir Mohamad alleged Pak Lah cutting off major project initiated by him. On the same day, all Chinese newspaper in Malaysia carried a news report that a strategist of Bank of America praise Malaysia fiscal policy and express confident in Malaysia currency compare to its previously and with other third world country in their economic and business section.

2) Over the past week, Umno Members of Parliament, Mentris Besar and the Barisan Nasional component leaders have all pledged their support to Abdullah. The expression of support has been overwhelming and certainly his control of Umno is unshakeable. The Star's columnist Wong Chun Wai write " But even those close to Dr Mahathir acknowledge the reality that it makes no sense for ambitious Umno politicians to back this retired politician who has no plans and no hope of coming back to power. It is only politically wise to invest in the present and the future, if one wants to climb the hierarchy. "

On 14 June 2006, The Court of Appeal has quashed Sukma's conviction for allowing his adopted brother Datuk Seri Anwar Ibrahim to sodomise him eight years ago. Justices Gopal Sri Ram, Hashim Mohd Yusoff and James Foong unanimously allowed Sukma's appeal and set aside the conviction and six-month jail sentence. A coincident?

Sukma convicted when Tun Mathathir was in power. A retrial order clearly is an embarrassment to Tun Dr Mahathir. Is this just a coincident or a warning to Tun Dr Mahathir?

Clearly, when Pak Lah face difficulties in getting police to accept IPCMC. Whether right or wrong. Pak Lah cannot afford to lose this battle.

Influence of people with other agenda

Tun Dr Mathathir also said:

But the present government can do a good job if they want to. The means are there but if they come under the influence of people who have other agendas, then I can’t help.

Who is the influential people with other agenda?

On 14 June 2006 issue of Oriental Daily. Matthias Chang, the former political secretary of Tun Dr Mahathir Mohamad said Kalimullah Masheerul Hassan and Khairy Jamaluddin are the people who influence the PM, and challenge the two to debate with him.

Kalimullah is the New Straits Times Press deputy chairman and editorial adviser while Khairy is Abdullah's son-in-law of PM and Pemuda Umno deputy chief.

Both are directors of ECM Libra. Kalimullah is Executive Chairman and Co-Chief Executive Officer while Khairy is Director of Investment Banking in ECM Libra.

Clearly ECM Libra is the most influential merchant banker in Malaysia. At least it is like Phileo Allied Bank when Anwar Ibrahim was Finance Minister, if not more influential. ECM Libra is in the process of merger with Avenue Capital Resources Bhd.

The risk of investment in ECM Libra is they involve in political controversial like with Matthias Chang and a lot others. This is a great political risk you must excess before you put your money in.

TechnoratiTag: Commentary Malaysia Opinion Shares Stock Market klse News and politics Politik

Wednesday, June 14, 2006

"All In" a story on gaming and casino industry staring Song Hae-Gyo (宋慧乔)

On 13 June 2006, Malaysia free to air TV NTV7 started to broadcast a South Korea Drama "All In" on 9.30pm every night, is a story base on casino and gaming industry.

Some claim that it is base on a true story in South Korea.

From con man, gangster to casino senior executive and later tycoon

The story of Kim In-ha(Lee Byung Hun) , who follow his uncle Kim Chi-soo gambling and hustling to make a living and eventually ends up as a (partner-in-crime) with his uncle to con people via gambling. Kim In-ha grows up under such circumstances has picked up the skill of gambling.

He has a bunch of friends and they are street kids who hang out in the poor area of Yong-doo Pu, committing petty crimes and getting into fights, an act like gangster.

Kim In-ha end up in jail after a gang fight which he accidentally kill a man.

Upon release from jail. His only skill at that point of time......... Fighting let him end up as security guards in a casino in Cheju Island of Korea. Where he meet his ex-girl friend Su-yon (Song Hae Gyo(宋慧乔))who become coupler in the casino.

Kim In-ha's gambling instincts is also recognised by Director Suh, and is quickly promoted to the position of Pit Boss in the casino, a Senior Executive position and start a life in gaming and casino industry.

Kim In-ha's gambling instincts is also recognised by Director Suh, and is quickly promoted to the position of Pit Boss in the casino, a Senior Executive position and start a life in gaming and casino industry."All in" is a term used in poker, usually in HK movies. They call it "Showhand"", i.e. to gamble all your capital and stake everything.

The scenic Cheju Island was the main setting for the entire serial. Besides Cheju Island, part of the production was filmed in Las Vegas. It gave a fairly detailed, insightful and interesting outline of the casino and hotel business. The serial also threw some light on triad struggles, and the involvement of the triad world with the corporate world.

This is a famous South Korea drama that star by Song Hae-Gyo (宋慧乔). I never watch all movies star by Song. However, I feel she look the most prettiest in this drama on all the drama I have watched.

If you never watch this drama before, it is a drama you unable to miss.

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Media Stock Market klse

Monday, June 12, 2006

528 anniversary and Nanyang's story

Last month 28 May 2006 was 5th anniversary of 528 incident, where Nanyang was taken over by Huaren Holdings, an investment arm control by Malaysia Chinese Association(MCA).

Oriental daily run a series articles revealing what happen during that time.

Former employee of Sin Chew Daily of Tan Sri Tiong, now advisor of Oriental Daily reveal that when he was still employed by Sin Chew Daily. Tan Sri Tiong has assigned him to negotiated with Hong Leong Tan Sri Kwek in 1990an to try to acquired Nanyang but fail.

In 8 February 2001, after meeting with Tan Sri Kwek in Hong Leong HQ in KL. Managing Director(MD) of Nanyang Mr Wong was on the way back to Nanyang building. While in KESAS highway, the MD received a call informing him that a lady who claim herself representing Sin Chew's Tan Sri Tiong call Miss Sandra has come to Hong Leong HQ without any appointment requested to meet Tan Sri Kwek Leng Chan. Sources said Miss Sandra said "they" willing to negotiate any price tag offer by Hong Leong to dispose off Nanyang.

After short meeting, Sandra was told the deal was negotiable and suggested her to contact and negotiate with Managing Director of Nanyang Mr Wong. The MD was instructed by Hong Leong to handle the negotiation. However, Sandra never show up after that.

After that incident, rumors in the market said that Hong Leong was pressure to sell.

On 14 May 2001, The Edge reported that Huaren Holding intended to acquired stake in Nanyang.

On 24 May 2001, The Board of Director of Nanyang met at Hong Leong HQ. They pass resolution of shares sales and requested 9 blacklisted employee to resigned.

At the night of 28 May 2001, employee from Sin Chew Daily come and take over the management and editorial office of Nanyang.

Even on 6 August 2002, The Edge reported that Market talks have it that Mah King Hock who control 23.8% of Nanyang is a close associate of Tiong.

On 15 March 2006, Oriental Daily reported that Madigreen become the second largest shareholders of Nanyang after Madigreen acquired stake from Mr Mah King Hock. Oriental Daily also speculated that Madigreen ultimately control by Sin Chew Tan Sri Tiong. Both Sin Chew Daily and Nanyang remain low profile on shareholders changes.

Tan Sri Tiong history

Tan Sri Tiong has a history of closed down a Sarawak base newspaper after acquired by Tan Sri Tiong. Subsciber of such newspaper was replaced by subscription to West Malaysia Sin Chew Daily.

This cause East Malaysia players such as See Hua Daily (published by Datuk Seri Lau Hui Kang's KTS group) started seeing competition from Sin Chew in 1997 and started Oriental Daily to compete with Sin Chew Daily in West Malaysia.

As Nanyang is a public listed company and the fact that Tan Sri Tiong has history of close down a newspaper it acquired and replaced by Sin Chew Daily. It is unfair to minority shareholder of Nanyang as they never told whether Tan Sri Tiong would closed down Nanyang and replaced all Nanyang subscriber by Sin Chew. Nanyang should disclose it future plan to it shareholder.

My guess : Guang Ming to merge with China Press?

As there is no disclosure from Nanyang management and the history of Tan Sri Tiong above. It would be foolish if you want to buy Nanyang shares and treated as investment in Nanyang. Anyhow Nanyang result is not good at the moment. The Crown Jewels in Nanyang is China Press. China Press, China Press is now the second largest circulated Chinese newspaper, selling an average of 223,890 copies daily, including night sales, compared to Nanyang Siang Pau's 140,493.

While Tan Sri Tiong's Guang Ming Daily has a daily circulation of 137,960 copies. It is logical Tan Sri Tiong would want to close down Guang Ming Daily and replaced by China Press circulation, This can boost China Press circulation overnight, to compensate loss of Guang Ming Daily. He might close down Nanyang and replace by Sin Chew Daily. After this merger, Tan Sri Tiong would control both the upper and lower segment of Chinese newspaper market, he able to maintain both listed company Sin Chew and Nanyang(Might change to China Press)

Nanyang's strength

Nanyang full name is Nanyang Siang Pau. Siang Pau mean Business Daily, Nanyang's strength is in it business report. I like to read Nanyang business section than Sin Chew Daily, it coverage on China market and it Monday's edition all more superior than Sin Chew Daily. Thus, journalist in Nanyang's business section are expected to be able to keep their job.

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance SharesMedia Stock Market klse

Oriental daily run a series articles revealing what happen during that time.

Former employee of Sin Chew Daily of Tan Sri Tiong, now advisor of Oriental Daily reveal that when he was still employed by Sin Chew Daily. Tan Sri Tiong has assigned him to negotiated with Hong Leong Tan Sri Kwek in 1990an to try to acquired Nanyang but fail.

In 8 February 2001, after meeting with Tan Sri Kwek in Hong Leong HQ in KL. Managing Director(MD) of Nanyang Mr Wong was on the way back to Nanyang building. While in KESAS highway, the MD received a call informing him that a lady who claim herself representing Sin Chew's Tan Sri Tiong call Miss Sandra has come to Hong Leong HQ without any appointment requested to meet Tan Sri Kwek Leng Chan. Sources said Miss Sandra said "they" willing to negotiate any price tag offer by Hong Leong to dispose off Nanyang.

After short meeting, Sandra was told the deal was negotiable and suggested her to contact and negotiate with Managing Director of Nanyang Mr Wong. The MD was instructed by Hong Leong to handle the negotiation. However, Sandra never show up after that.

After that incident, rumors in the market said that Hong Leong was pressure to sell.

On 14 May 2001, The Edge reported that Huaren Holding intended to acquired stake in Nanyang.

On 24 May 2001, The Board of Director of Nanyang met at Hong Leong HQ. They pass resolution of shares sales and requested 9 blacklisted employee to resigned.

At the night of 28 May 2001, employee from Sin Chew Daily come and take over the management and editorial office of Nanyang.

Even on 6 August 2002, The Edge reported that Market talks have it that Mah King Hock who control 23.8% of Nanyang is a close associate of Tiong.

On 15 March 2006, Oriental Daily reported that Madigreen become the second largest shareholders of Nanyang after Madigreen acquired stake from Mr Mah King Hock. Oriental Daily also speculated that Madigreen ultimately control by Sin Chew Tan Sri Tiong. Both Sin Chew Daily and Nanyang remain low profile on shareholders changes.

Tan Sri Tiong history

Tan Sri Tiong has a history of closed down a Sarawak base newspaper after acquired by Tan Sri Tiong. Subsciber of such newspaper was replaced by subscription to West Malaysia Sin Chew Daily.

This cause East Malaysia players such as See Hua Daily (published by Datuk Seri Lau Hui Kang's KTS group) started seeing competition from Sin Chew in 1997 and started Oriental Daily to compete with Sin Chew Daily in West Malaysia.

As Nanyang is a public listed company and the fact that Tan Sri Tiong has history of close down a newspaper it acquired and replaced by Sin Chew Daily. It is unfair to minority shareholder of Nanyang as they never told whether Tan Sri Tiong would closed down Nanyang and replaced all Nanyang subscriber by Sin Chew. Nanyang should disclose it future plan to it shareholder.

My guess : Guang Ming to merge with China Press?

As there is no disclosure from Nanyang management and the history of Tan Sri Tiong above. It would be foolish if you want to buy Nanyang shares and treated as investment in Nanyang. Anyhow Nanyang result is not good at the moment. The Crown Jewels in Nanyang is China Press. China Press, China Press is now the second largest circulated Chinese newspaper, selling an average of 223,890 copies daily, including night sales, compared to Nanyang Siang Pau's 140,493.

While Tan Sri Tiong's Guang Ming Daily has a daily circulation of 137,960 copies. It is logical Tan Sri Tiong would want to close down Guang Ming Daily and replaced by China Press circulation, This can boost China Press circulation overnight, to compensate loss of Guang Ming Daily. He might close down Nanyang and replace by Sin Chew Daily. After this merger, Tan Sri Tiong would control both the upper and lower segment of Chinese newspaper market, he able to maintain both listed company Sin Chew and Nanyang(Might change to China Press)

Nanyang's strength

Nanyang full name is Nanyang Siang Pau. Siang Pau mean Business Daily, Nanyang's strength is in it business report. I like to read Nanyang business section than Sin Chew Daily, it coverage on China market and it Monday's edition all more superior than Sin Chew Daily. Thus, journalist in Nanyang's business section are expected to be able to keep their job.

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance SharesMedia Stock Market klse

Friday, June 09, 2006

Competitiveness of South Korea Lotte Group

When talking about South Korea, people outside South Korea used to talk about Samsung, Hyundai, LG and even SK Group and Daewoo.

However, another company call Lotte is gaining competitive. Start from chewing cum and diversified to other food and beverage industry initially and later leisure and theme park industry. Now Lotte group dominated retail industry in South Korea via Lotte Shopping and Lotte Mart.

First, French retail giant Carrefour feel they unable to dominate the South Korea market. Carrefour disposed off its 32 hypermarket in South Korea to E. Land, a fashion retailer in South Korea.

Later, US retail giant WalMart also disposed off it 16 hypermaket to Sinsegae group's E-MART.

In South Korea Coke market, multinational Coca-cola only have 20% of market shares. Lotte's Lotte Chilsung have a 40% dominated market shares.

In fast food, McDonald also have difficulties competing with Lotte's Lotteria.

While Samsung and Hyundai represented organic growth manufacturing giant and Daewoo represent M&A manufacturing giant. SK and Lotte represent the new generation of giant in service industry.

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares

However, another company call Lotte is gaining competitive. Start from chewing cum and diversified to other food and beverage industry initially and later leisure and theme park industry. Now Lotte group dominated retail industry in South Korea via Lotte Shopping and Lotte Mart.

First, French retail giant Carrefour feel they unable to dominate the South Korea market. Carrefour disposed off its 32 hypermarket in South Korea to E. Land, a fashion retailer in South Korea.

Later, US retail giant WalMart also disposed off it 16 hypermaket to Sinsegae group's E-MART.

In South Korea Coke market, multinational Coca-cola only have 20% of market shares. Lotte's Lotte Chilsung have a 40% dominated market shares.

In fast food, McDonald also have difficulties competing with Lotte's Lotteria.

While Samsung and Hyundai represented organic growth manufacturing giant and Daewoo represent M&A manufacturing giant. SK and Lotte represent the new generation of giant in service industry.

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares

Wednesday, June 07, 2006

Telenor set up research centre in Malaysia despite DiGi unable to get 3G license.

Telenor has opened a research and innovation centre (R&I) in Cyberjaya on 24 May 2006 despite it subsidiary in Malaysia DiGi unable to get 3G spectrum License in Malaysia.

“The centre, Telenor's first research facility to be located outside Norway, is another step in the company's internationalisation process and global innovation activities,” senior executive vice-president/head of Asian operations, Arve Johansen, said in a statement.

The centre is headed by managing director Dr Kristin Braa.

Telenor was reputable of it high tech open concept headquarter in Norway. DiGi's has built a smaller copy of such high tech building as it corporate headquarters in Shah Alam - is in its final stage of completion. I really envy DiGi employee who has the opportunity to work in such high tech building.

DiGi shares price hit RM9.30 on April 2006. DiGi shares price hit highest at RM11.70 on 8 May 2006. It close RM10.40 yesterday.

Earlier, on 19 May 2006, DiGi.Com Bhd expects net profit to grow at least 20% for the current financial year ending Dec 31.

For the first quarter ended March 31, 2006, net profit tripled to RM184.66 million from RM57.96 million a year ago due to improved margins and lower depreciation costs. The net profit, if annualised, would be RM738 million, exceeding most analysts’ estimates of RM566.62 million for the current financial year ending Dec 31, 2006.

Previously when I state in my blog post highlighting that DiGi shares price would hit RM9.30. A reader who unable to keep a job in research house post a comment in my blog claiming that smart investor never listen to analyst recommendations.

History, however, has proved that my blog post is accurate and his comment has come back to bite him.

Today, DiGi launch a talent search competition that focuses on a younger age group-DiGi Celebriteen.

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

“The centre, Telenor's first research facility to be located outside Norway, is another step in the company's internationalisation process and global innovation activities,” senior executive vice-president/head of Asian operations, Arve Johansen, said in a statement.

The centre is headed by managing director Dr Kristin Braa.

Telenor was reputable of it high tech open concept headquarter in Norway. DiGi's has built a smaller copy of such high tech building as it corporate headquarters in Shah Alam - is in its final stage of completion. I really envy DiGi employee who has the opportunity to work in such high tech building.

DiGi shares price hit RM9.30 on April 2006. DiGi shares price hit highest at RM11.70 on 8 May 2006. It close RM10.40 yesterday.

Earlier, on 19 May 2006, DiGi.Com Bhd expects net profit to grow at least 20% for the current financial year ending Dec 31.

For the first quarter ended March 31, 2006, net profit tripled to RM184.66 million from RM57.96 million a year ago due to improved margins and lower depreciation costs. The net profit, if annualised, would be RM738 million, exceeding most analysts’ estimates of RM566.62 million for the current financial year ending Dec 31, 2006.

Previously when I state in my blog post highlighting that DiGi shares price would hit RM9.30. A reader who unable to keep a job in research house post a comment in my blog claiming that smart investor never listen to analyst recommendations.

History, however, has proved that my blog post is accurate and his comment has come back to bite him.

Today, DiGi launch a talent search competition that focuses on a younger age group-DiGi Celebriteen.

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

Monday, June 05, 2006

Nazri next UMNO vice-President?!

Minister in the Prime Minister Department Datuk Seri Mohd Nazri Abdul Razak has been appear high profile recently.

Whether you like him because he did a good job as a Chairman of Human Right Caucus or you dislike him because he instructed women Senator to vote for a Bill that put Islamic women in disadvantage, or you dislike him because you support ex-Backbencher Club President Shahrir Samad. Nazri is constantly on the news.

Even the other two UMNO vice-President, Melaka Menteri Besar Datuk Seri Mohd Ali Rustam and Agriculture Minister Tan Sri Muyiddin Yasin do not have such publicity enjoyed by Nazri. He has seen constantly liaise with Prime Minister and Deputy Prime Minister and party whip on Parliament issue. The other two vice-President never seen liaise with UMNO number one and number two that closely like Nazri.

Earlier, Nazri responsibility expanded in a cabinet reshuffle. Nazri has assigned to cover Datuk Seri Radzi Sheikh Ahmad's portfolio after the later transfer as Home Minister.

While another UMNO vice-President Isa has been suspended. His position are expected to be fill by UMNO Youth Chief and Education Minister Datuk Seri Hishammuddin Tun Hussein in the next UMNO election by the public.

Melaka Menteri Besar Datuk Seri Mohd Ali Rustam who get highest nomination during last UMNO election, are expected to be able to retain his position unless some unforeseen circumtances occur.

Thus, a direct fight between Nazri and Agriculture Minister Tan Sri Muyiddin Yasin is unavoidable if Nazri intended to move up.

Whether the high-profile and publicity enjoy by Nazri would get him more enemy or make him more popular is yet to be seen.

TechnoratiTag:Commentary competitive Malaysia News and politics Opinion Politik Social

Whether you like him because he did a good job as a Chairman of Human Right Caucus or you dislike him because he instructed women Senator to vote for a Bill that put Islamic women in disadvantage, or you dislike him because you support ex-Backbencher Club President Shahrir Samad. Nazri is constantly on the news.

Even the other two UMNO vice-President, Melaka Menteri Besar Datuk Seri Mohd Ali Rustam and Agriculture Minister Tan Sri Muyiddin Yasin do not have such publicity enjoyed by Nazri. He has seen constantly liaise with Prime Minister and Deputy Prime Minister and party whip on Parliament issue. The other two vice-President never seen liaise with UMNO number one and number two that closely like Nazri.

Earlier, Nazri responsibility expanded in a cabinet reshuffle. Nazri has assigned to cover Datuk Seri Radzi Sheikh Ahmad's portfolio after the later transfer as Home Minister.

While another UMNO vice-President Isa has been suspended. His position are expected to be fill by UMNO Youth Chief and Education Minister Datuk Seri Hishammuddin Tun Hussein in the next UMNO election by the public.

Melaka Menteri Besar Datuk Seri Mohd Ali Rustam who get highest nomination during last UMNO election, are expected to be able to retain his position unless some unforeseen circumtances occur.

Thus, a direct fight between Nazri and Agriculture Minister Tan Sri Muyiddin Yasin is unavoidable if Nazri intended to move up.

Whether the high-profile and publicity enjoy by Nazri would get him more enemy or make him more popular is yet to be seen.

TechnoratiTag:Commentary competitive Malaysia News and politics Opinion Politik Social

Thursday, June 01, 2006

Mandarin demand:discriminatory or courtesy

The Deputy Prime Minister Datuk Seri Najib Tun Razak said when winding up the debate on the Ninth Malaysia Plan at Dewan Negara yesterday that the private sector should stop the practice of making it compulsory for local graduates to be proficient in Mandarin.

The next day, Human Resources Minister Datuk Dr Fong Chan Onn said the requirement for prospective employees to be fluent in Mandarin should be made optional.

Clearly, when you are in certain categories. You would feel upset when a job advertisement excluding your categories to apply for certain job.

I have a friend who is in middle age. He always feel discriminate and upset when he saw a job advertisement stating that application should not be over 35 years old. He also upset the Pak Lah government appointing young CEO to head Government Link Company (GLC). He said those young people lack the experience required for such a position.

I even see A Kadir Jasin, a veteren journalist criticize Pak Lah government appointing young people to handle the Prime Mininster's press office.

If you do not known Mandarin, you will feel discriminate and upset when you see a job advertisement stating ptoficient in Mandarin as a requirment to apply for certain position.

However, I feel it is better for a job advertisement to state clearly what is the requirement for certain job, so that I do not waste my time in applying a position that I would not get employed.

This also enable me to know what I lack of or which area or skill I have to improve.

What difficulties a large organization to ask an officer to handle "courtesy interview"?

When I was employed by a Main Board listed company(Now PN17) as an Assistant Accountant. The company place an advertisement for "walk in interview". My department head who want to employed a person who know Mandarin but never stated in the advertisement.

A lot of candidates take the trouble to come to our office for walk in interview and they spend hours to fill up the form and waiting for their turn of interview.

I was ask by my Manager to conduct courtesy interview for those who do not qualified after perusal their forms. The candidate who spend hours travelling to our office, filling up their form, and waiting long hours for their turn of interview, will send to my room for courtesy interview which last for less than 2 minutes. The candidates will ask to go back to wait for company call if successful, which usually not.

Thus, would it be better for the candidate being told earlier the requirement and they need not apply if they unable to fullfill certain requirement. This safe the company time and safe the time of candidates.

I encounter a lot of non-chinese who able to speak fluent Mandarin. They usually "bertudung". Look for Tini in Citi Bank or visit a stationery shop in Taman Desa, Off Old Klang Road if you want to see one.

Related Link: We need to be more marketable By WONG CHUN WAI

TechnoratiTag: Commentary Malaysia Opinion Social

The next day, Human Resources Minister Datuk Dr Fong Chan Onn said the requirement for prospective employees to be fluent in Mandarin should be made optional.

Clearly, when you are in certain categories. You would feel upset when a job advertisement excluding your categories to apply for certain job.

I have a friend who is in middle age. He always feel discriminate and upset when he saw a job advertisement stating that application should not be over 35 years old. He also upset the Pak Lah government appointing young CEO to head Government Link Company (GLC). He said those young people lack the experience required for such a position.

I even see A Kadir Jasin, a veteren journalist criticize Pak Lah government appointing young people to handle the Prime Mininster's press office.

If you do not known Mandarin, you will feel discriminate and upset when you see a job advertisement stating ptoficient in Mandarin as a requirment to apply for certain position.

However, I feel it is better for a job advertisement to state clearly what is the requirement for certain job, so that I do not waste my time in applying a position that I would not get employed.

This also enable me to know what I lack of or which area or skill I have to improve.

What difficulties a large organization to ask an officer to handle "courtesy interview"?

When I was employed by a Main Board listed company(Now PN17) as an Assistant Accountant. The company place an advertisement for "walk in interview". My department head who want to employed a person who know Mandarin but never stated in the advertisement.

A lot of candidates take the trouble to come to our office for walk in interview and they spend hours to fill up the form and waiting for their turn of interview.

I was ask by my Manager to conduct courtesy interview for those who do not qualified after perusal their forms. The candidate who spend hours travelling to our office, filling up their form, and waiting long hours for their turn of interview, will send to my room for courtesy interview which last for less than 2 minutes. The candidates will ask to go back to wait for company call if successful, which usually not.

Thus, would it be better for the candidate being told earlier the requirement and they need not apply if they unable to fullfill certain requirement. This safe the company time and safe the time of candidates.

I encounter a lot of non-chinese who able to speak fluent Mandarin. They usually "bertudung". Look for Tini in Citi Bank or visit a stationery shop in Taman Desa, Off Old Klang Road if you want to see one.

Related Link: We need to be more marketable By WONG CHUN WAI

TechnoratiTag: Commentary Malaysia Opinion Social

Muhibbah Engineering bidding for Penang second bridge

Mini Hyundai of Malaysia, Muhibbah Engineering, was one of the four companies tendered for the second bridge linking Penang island and the mainland. Two other companies were foreign – from China and South Korea. And another local is a subsidiary of Arab Malaysian Bank.

However, Works Minister Datuk Seri S. Samy Vellu said the Government preferred a consortium made up of several companies because the project was huge.

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

However, Works Minister Datuk Seri S. Samy Vellu said the Government preferred a consortium made up of several companies because the project was huge.

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

Wednesday, May 31, 2006

Opposition should make their stand on IPCMC

mThe Royal Malaysian Police (RMP), which had made known its objection to the setting up of the Independent Police Complaints and Misconduct Commission (IPCMC), has published ten reasons why IPCMC is not needed.

Opposition party in Malaysia should make their stand on whether they support or oppose the setting up of IPCMC. I think oppositon whip would not follow Barisan whip in opposing a suggestion by their counter party.

Blogger Jeff Ooi has list the reason we need IPCMC on his blog.

In The NST, the PM was quoted as saying:

Abdullah stressed that he had reminded Attorney-General Tan Sri Gani Patail to consider all the proposals made. "As far as I am concerned, the IPCMC is important to me. I have handed the matter over to the A-G for his action," he said.

Malaysian Business's Editors-in-Chief, A Kadir Jasin has express his disappointment on some UMNO leader opposed the setting up of IPCMC in Parliament and on the press in his column "Other Thots".

The threat has been removed from Police website: quoted screeshots.

Clearly, even the Prime Minister feel it is difficult to manage such a large police force and UMNO leader feel difficult to offend the police.

It might be time to reconsider my suggestion to let police under state government rather then under federal government.

Related Link: Misyar, Matrade and the IPCMC by TUN HANIF OMAR

IPCMC: Polis lwn Kerajaan by A Kadir Jasin

TechnoratiTag:Commentary competitive Malaysia News and politics Opinion Politik Social

Opposition party in Malaysia should make their stand on whether they support or oppose the setting up of IPCMC. I think oppositon whip would not follow Barisan whip in opposing a suggestion by their counter party.

Blogger Jeff Ooi has list the reason we need IPCMC on his blog.

In The NST, the PM was quoted as saying:

Abdullah stressed that he had reminded Attorney-General Tan Sri Gani Patail to consider all the proposals made. "As far as I am concerned, the IPCMC is important to me. I have handed the matter over to the A-G for his action," he said.

Malaysian Business's Editors-in-Chief, A Kadir Jasin has express his disappointment on some UMNO leader opposed the setting up of IPCMC in Parliament and on the press in his column "Other Thots".

The threat has been removed from Police website: quoted screeshots.

Clearly, even the Prime Minister feel it is difficult to manage such a large police force and UMNO leader feel difficult to offend the police.

It might be time to reconsider my suggestion to let police under state government rather then under federal government.

Related Link: Misyar, Matrade and the IPCMC by TUN HANIF OMAR

IPCMC: Polis lwn Kerajaan by A Kadir Jasin

TechnoratiTag:Commentary competitive Malaysia News and politics Opinion Politik Social

Thursday, May 25, 2006

Malaysia Electricity rate should lower than Taiwan

Energy, Water and Communications Minister Datuk Seri Dr Lim Keng Yaik announced the Cabinet's decision yesterday that electricity tariff in the peninsula Malaysia will go up by 12% from June 1.

Oriental Daily has published a schedule comparing Malaysia electricity rate with other country. Malaysia appear to be among the lowest in Asia. Malaysia electricity tariff only higher than Indonesia and Taiwan.

While it is reasonable for Malaysia electricity tariff to be higher than Indonesia as our cost of living is higher than Indonesia. It is surprising to know that Malaysia electricity tariff rate will be higher than Taiwan after the tariff hike.

Taiwan can be consider a develop country in Asia like Singapore. A lot of Taiwan investor invest in Malaysia because of our cost of manufacturing lower than Taiwan before the China boom. Now, our cost of electricity has increased to more than Taiwan. Are we encourage Taiwan manufacturer here to move back to Taiwan if not shift to low cost China.

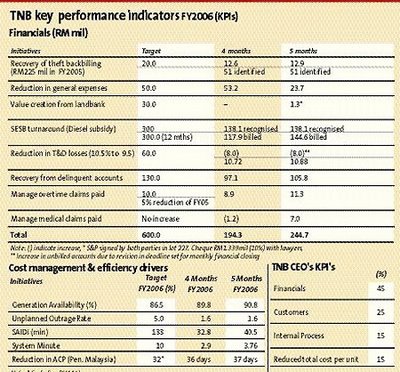

TNB management should learn from their Taiwan counterpart on how to operate at such a low cost. TNB Key performance indicator (KPI) should benchmark against their Taiwan counterpart.

If such a high cost country in Taiwan able to keep their electricity rate low. There is no reason that Malaysia, a petroleum production country unable to do that.

Recent IMD report show that Malaysia competitiveness is still behind Taiwan despite we have a lower cost of living. Malaysia competitiveness might be deteriorated if our electricity rate is higher than silicon valley of Asia and do not have company like Acer, BenQ, Taiwan Semiconductor Manufacturing Company(TSMC) etc.

Link to this page: Globle Voice Online

Related post : Contradict reveal by Tenaga's chief and Energy Minister

Why Tenaga should be delisted!

TechnoratiTag:Business Commentary Economics Economy Malaysia News and politics Opinion Politik Shares Stock Market klse

Oriental Daily has published a schedule comparing Malaysia electricity rate with other country. Malaysia appear to be among the lowest in Asia. Malaysia electricity tariff only higher than Indonesia and Taiwan.

While it is reasonable for Malaysia electricity tariff to be higher than Indonesia as our cost of living is higher than Indonesia. It is surprising to know that Malaysia electricity tariff rate will be higher than Taiwan after the tariff hike.

Taiwan can be consider a develop country in Asia like Singapore. A lot of Taiwan investor invest in Malaysia because of our cost of manufacturing lower than Taiwan before the China boom. Now, our cost of electricity has increased to more than Taiwan. Are we encourage Taiwan manufacturer here to move back to Taiwan if not shift to low cost China.

TNB management should learn from their Taiwan counterpart on how to operate at such a low cost. TNB Key performance indicator (KPI) should benchmark against their Taiwan counterpart.

If such a high cost country in Taiwan able to keep their electricity rate low. There is no reason that Malaysia, a petroleum production country unable to do that.

Recent IMD report show that Malaysia competitiveness is still behind Taiwan despite we have a lower cost of living. Malaysia competitiveness might be deteriorated if our electricity rate is higher than silicon valley of Asia and do not have company like Acer, BenQ, Taiwan Semiconductor Manufacturing Company(TSMC) etc.

Link to this page: Globle Voice Online

Related post : Contradict reveal by Tenaga's chief and Energy Minister

Why Tenaga should be delisted!

TechnoratiTag:Business Commentary Economics Economy Malaysia News and politics Opinion Politik Shares Stock Market klse

Wednesday, May 24, 2006

Entrepreneur or Investor?

I have commented on OYL Industries Bhd and Hong Leong could be Samsung of Malaysia before.

Last Thursday, Hong Leong and its Executive Chairman, Billionaire Tan Sri Quek Leng Chan is leading the disposal of global air-conditioning manufacturer, OYL Industries Bhd, to Japan's Daikin Industries Ltd in a cash deal worth a whopping RM7.61 billion.

This followed months of market talk that OYL might sell off its air-conditioning business or merge it with another multinational corporation.

HONG Leong Group Malaysia will receive a huge net cash inflow from the proceeds of RM3.04bil, having bought OYL very cheaply 16 years ago.

While the group had to subscribe to a large rights issue when OYL bought the US-based McQuay group in 1994, most of that cost would have been recovered from the dividends paid by OYL over the years.

The Edge's journalist Maryann Tan commented that : Perhaps no one applies the buy-low-sell-high principle better than Tan Sri Quek Leng Chan. The Edge further speculated that reported that Quek will pour money into BIL International. A company in gaming and leisure industry.

It's really disappointed that another entrepreneur I respect in Malaysia exist manufacturing business and pour money into leisure business.

While most reader of my blog might have gain some money in the takeover. It is really debatable whether Tan Sri Quek is an entrepreneur or an investor. While he is skillful investor in applying buy-low-sell-high strategy. Unlike Samsung's founder in South Korea, he never grow the company like Samsung.

However, there are a lot of entrepreneur like Matsushita in Japan make huge loss when he fail to exist Mainframe computer market that dominance by IBM at that point of time. South Korea's Daewo even become bankrupt when he unable to foreseen that his company unable to compete in automobile industries.

Thus, it really debatable whether Quek is an entrepreneur or an investor. The sad things is Malaysian loss a good company to Japanese. However, when the price reach billion. There are few Malaysian that able to swallow this huge company. After the disposal, all value chain in Eletrical and Electronic industriesin Malaysia has been dominated by multinational.

Electrical Appliance----->Semiconductor------>Computer

Panasonic/Daikin-------->Intel(MPI?)-------->Dell(Ftec?)

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

Background

OYL's operating margins have been on the decline on high raw material prices and stiff competition in the global market.

Its most recent quarterly results show earnings margins were down 3% despite a sharp 22% drop in prices of cold rolled steel coils, which accounted for 40% of its operating costs. Surging copper prices in recent months are likely to put more pressure on margins.

The Star reported that there is intense global competition, in particular, from South Korean consumer electronics groups. It is believed that The Star refer to South Korea's LG Electronic, which is competitive in air-conditioner market rather than Samsung, which strength is in Handphone and Audio visual product.

Speaking at a press conference to announce the acquisition, Daikin senior executive officer for global operations and board director Katsuhiko Takagi said the merged entity will have the second largest market share in the global air-conditioner business based on its combined sales of US$9 billion (RM32.44 billion) out of a total of US$60 billion, and he would be targeting for the company, in time, to be the world's largest. Currently, the world's largest is the US-based Carrier group.

The Hong Leong group is reaping the reward for having created value in OYL through McQuay. The American company was bought at a time when it was incurring losses due to its junk bond debts, which were progressively paid off when it was under OYL.

Critics noted that McQuay operated under thin profit margins on its huge sales in the United States and Europe. However, it was McQuay's technologies in air-conditioning that enabled the group to pursue a highly profitable expansion into China, other analysts said.

OYL's McQuay is the world's number four in large-scale commercial air-conditioning and AAF is world number three in air filtration products. OYL has a solid presence in China and the US, and Daikin has a leading position in Japan and Europe. Combined, we can significantly increase our global presence. Said Daikin senior executive officer (global operations) Katsuhiko Takagi.

AmResearch said OYL could derive benefits from being part of the Daikin family as it planned to expand air-conditioning operations into North America, India, Russia and Brazil.

Daikin said it was strong in products and technologies in the ductless air-conditioning segment, especially in high value-added air-conditioning, while OYL was strong in Applied business segment, and low-cost heating, ventilation, and air-conditioning products, with its low-cost mass-production technology.

Last Thursday, Hong Leong and its Executive Chairman, Billionaire Tan Sri Quek Leng Chan is leading the disposal of global air-conditioning manufacturer, OYL Industries Bhd, to Japan's Daikin Industries Ltd in a cash deal worth a whopping RM7.61 billion.

This followed months of market talk that OYL might sell off its air-conditioning business or merge it with another multinational corporation.

HONG Leong Group Malaysia will receive a huge net cash inflow from the proceeds of RM3.04bil, having bought OYL very cheaply 16 years ago.

While the group had to subscribe to a large rights issue when OYL bought the US-based McQuay group in 1994, most of that cost would have been recovered from the dividends paid by OYL over the years.

The Edge's journalist Maryann Tan commented that : Perhaps no one applies the buy-low-sell-high principle better than Tan Sri Quek Leng Chan. The Edge further speculated that reported that Quek will pour money into BIL International. A company in gaming and leisure industry.

It's really disappointed that another entrepreneur I respect in Malaysia exist manufacturing business and pour money into leisure business.

While most reader of my blog might have gain some money in the takeover. It is really debatable whether Tan Sri Quek is an entrepreneur or an investor. While he is skillful investor in applying buy-low-sell-high strategy. Unlike Samsung's founder in South Korea, he never grow the company like Samsung.

However, there are a lot of entrepreneur like Matsushita in Japan make huge loss when he fail to exist Mainframe computer market that dominance by IBM at that point of time. South Korea's Daewo even become bankrupt when he unable to foreseen that his company unable to compete in automobile industries.

Thus, it really debatable whether Quek is an entrepreneur or an investor. The sad things is Malaysian loss a good company to Japanese. However, when the price reach billion. There are few Malaysian that able to swallow this huge company. After the disposal, all value chain in Eletrical and Electronic industriesin Malaysia has been dominated by multinational.

Electrical Appliance----->Semiconductor------>Computer

Panasonic/Daikin-------->Intel(MPI?)-------->Dell(Ftec?)

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

Background

OYL's operating margins have been on the decline on high raw material prices and stiff competition in the global market.

Its most recent quarterly results show earnings margins were down 3% despite a sharp 22% drop in prices of cold rolled steel coils, which accounted for 40% of its operating costs. Surging copper prices in recent months are likely to put more pressure on margins.

The Star reported that there is intense global competition, in particular, from South Korean consumer electronics groups. It is believed that The Star refer to South Korea's LG Electronic, which is competitive in air-conditioner market rather than Samsung, which strength is in Handphone and Audio visual product.

Speaking at a press conference to announce the acquisition, Daikin senior executive officer for global operations and board director Katsuhiko Takagi said the merged entity will have the second largest market share in the global air-conditioner business based on its combined sales of US$9 billion (RM32.44 billion) out of a total of US$60 billion, and he would be targeting for the company, in time, to be the world's largest. Currently, the world's largest is the US-based Carrier group.

The Hong Leong group is reaping the reward for having created value in OYL through McQuay. The American company was bought at a time when it was incurring losses due to its junk bond debts, which were progressively paid off when it was under OYL.

Critics noted that McQuay operated under thin profit margins on its huge sales in the United States and Europe. However, it was McQuay's technologies in air-conditioning that enabled the group to pursue a highly profitable expansion into China, other analysts said.

OYL's McQuay is the world's number four in large-scale commercial air-conditioning and AAF is world number three in air filtration products. OYL has a solid presence in China and the US, and Daikin has a leading position in Japan and Europe. Combined, we can significantly increase our global presence. Said Daikin senior executive officer (global operations) Katsuhiko Takagi.

AmResearch said OYL could derive benefits from being part of the Daikin family as it planned to expand air-conditioning operations into North America, India, Russia and Brazil.

Daikin said it was strong in products and technologies in the ductless air-conditioning segment, especially in high value-added air-conditioning, while OYL was strong in Applied business segment, and low-cost heating, ventilation, and air-conditioning products, with its low-cost mass-production technology.

Friday, April 28, 2006

Stupid Singaporeans and Li Ao

Taiwan lawmaker(Independent Member of Parliament), writer, historian, ex-President candidate and TV host Li Ao, who recently ranked Singaporeans rather lower in natural intelligence to the people in Taiwan and Hong Kong has create a controversial in Singapore recently.

Taiwanese are scoundrels, but lovable, Hong Kong people are craftier, (Chinese mainlanders are unfathomable) and Singaporeans are stupider,?he said, adding that it is partially due to genetics. The original migrants who came here from China were of poor stock?

"Predictably, Singaporeans have reacted angrily to the terms stupid and poor genes, dismissing them as a popularity stunt that takes no account of their successful, modern achievements. This genetic weakness doesn't aptly describe todays diverse, more mature and worldly-wise generation. " write Seah Chiang Nee, a columnist at The Star base in Singapore.

However, Singapore, usually rank higher than Taiwan in world Competitive ranking; It is one of the lowest crime rate, lowest corruption rate in the world. Li Ao, a historian and a writer in Taiwan who used to oppose Chiang family (First & Second President) and ruling party Kuo Min Tang in Taiwan was view as a hero in Taiwan especially among ladies.

Although he is just a writer, he do not lack of sex partner and he marriaged to an actress before. He reveal all his sex relation and romantic affairs in his autobiography. This really unethic as majority of his ex-girl friend has marriage with husband and children. This has create difficulties to his ex-girl friend and their family.

He pround of his ability to attract ladies. Once he mentioned that a person who pass exam in ancient China to become a high ranking official or a Minister of emperor in China. His wife heard the news was happy initially. However jeoleous family member who husband unable to pass such exam told her that emperor would chop off his husband cock in order to become high ranking official and Minister. When the person back home, his wife look worried and not happy. The man confused and ask his wife why she is not happy when he able to become a Minister. The wife reply that she do not wish her husband become Minister but without cock. The husband said no such thing and show his cock to his wife. The wife become happy and laugh eventually when she saw her husband cock still remain intact. The man said that why my wife is not happy even I become a Minister. Sex satisfaction is more important than become Minister. It is not sure Li Ao get this story via history study (He is historian) or he try to use this story to show off to all the ruling party Minister to imply that he is more happy even he is not a high ranking official and a Minister.

In recent trip to Singapore to clarifiedarrified his "Stupid" remark to Singaporean. He praise Lee Kuan Yew to lead Singaapore to achieved present status.

Some commentator claim that if Li Ao live in Singapore. Judging from how Lee Kuan Yew treated his opposition. What is the fate of Li Ao is yet to be determine.

Li Ao, after release from jail, still able to join politic and become independent legislator in Taiwan. He also try to become Taiwan President in one of the previous election. He also become a host in Phoenixt TV station in Taiwan. His program able to view at Astro in Malaysia.

TechnoratiTag: Business Commentary Malaysia Opinion News and politics Politik

Taiwanese are scoundrels, but lovable, Hong Kong people are craftier, (Chinese mainlanders are unfathomable) and Singaporeans are stupider,?he said, adding that it is partially due to genetics. The original migrants who came here from China were of poor stock?

"Predictably, Singaporeans have reacted angrily to the terms stupid and poor genes, dismissing them as a popularity stunt that takes no account of their successful, modern achievements. This genetic weakness doesn't aptly describe todays diverse, more mature and worldly-wise generation. " write Seah Chiang Nee, a columnist at The Star base in Singapore.

However, Singapore, usually rank higher than Taiwan in world Competitive ranking; It is one of the lowest crime rate, lowest corruption rate in the world. Li Ao, a historian and a writer in Taiwan who used to oppose Chiang family (First & Second President) and ruling party Kuo Min Tang in Taiwan was view as a hero in Taiwan especially among ladies.

Although he is just a writer, he do not lack of sex partner and he marriaged to an actress before. He reveal all his sex relation and romantic affairs in his autobiography. This really unethic as majority of his ex-girl friend has marriage with husband and children. This has create difficulties to his ex-girl friend and their family.

He pround of his ability to attract ladies. Once he mentioned that a person who pass exam in ancient China to become a high ranking official or a Minister of emperor in China. His wife heard the news was happy initially. However jeoleous family member who husband unable to pass such exam told her that emperor would chop off his husband cock in order to become high ranking official and Minister. When the person back home, his wife look worried and not happy. The man confused and ask his wife why she is not happy when he able to become a Minister. The wife reply that she do not wish her husband become Minister but without cock. The husband said no such thing and show his cock to his wife. The wife become happy and laugh eventually when she saw her husband cock still remain intact. The man said that why my wife is not happy even I become a Minister. Sex satisfaction is more important than become Minister. It is not sure Li Ao get this story via history study (He is historian) or he try to use this story to show off to all the ruling party Minister to imply that he is more happy even he is not a high ranking official and a Minister.

In recent trip to Singapore to clarifiedarrified his "Stupid" remark to Singaporean. He praise Lee Kuan Yew to lead Singaapore to achieved present status.

Some commentator claim that if Li Ao live in Singapore. Judging from how Lee Kuan Yew treated his opposition. What is the fate of Li Ao is yet to be determine.

Li Ao, after release from jail, still able to join politic and become independent legislator in Taiwan. He also try to become Taiwan President in one of the previous election. He also become a host in Phoenixt TV station in Taiwan. His program able to view at Astro in Malaysia.

TechnoratiTag: Business Commentary Malaysia Opinion News and politics Politik

Tuesday, April 25, 2006

Scenic bridge - Gainer and loser

The debate of Scenic Bridge continue. However, the debate focus on government to government and national pride. However, few body analyze the benefit and threat of Scenic Bridge to the people.

Gainer

1 Link Kedua Sdn Bhd - Operator of Second Crossing between Malaysia and Singapore. The second link still have extra capacity and under utilize. If the causeway has been demolished. traffic in second link will increase. Link Kedua might able to increase it toll rate to boost traffic. However, recent fuel hike received unwelcome response from people. This might be one of the reason government do not wish to proceed with Scenic Bridge.

2 Gerbang Perdana Sdn Bhd - Whether the government would like to proceed to build the Scenic bridge or not Gerbang Perdana Sdn Bhd would gain from it. It the government proceed with the project. As a concession holder of the Scenic Bridge, Gerbang Perdana would be the main beneficiary. It get compensation if government do not wish to proceed with the project.

3 Johor Port and Port of Tanjung Pelepas - Both port control by bumiputra tycoon Tan Sri Syed Moktar. If Malaysia able to demolish the causeway and replace by a bridge. This would enhance the competitiveness of both port against Singapore. Syed Moktar also control 20% of Gerbang Perdana via DRB-Hicom group.

Loser

1 People from both country - People from both country will be subjected to higher toll rate once the causeway is being demolished.

2 Transporter - transporter, who is major user of the causeway and second link. Would have to pay higher toll rate.

3 Tax payer - Tax payer become loser especially government have to pay enormous compensation to Gerbang Perdana.

4 Port Authority of Singapore - Malaysia port become more competitive and this will eaten Singapore's market shares in port management.

Conclusion

1 Singapore's people and it port authority become the main loser if government proceed with Scenic Bridge. Thus, Singapore do not want the bridge and Malaysia need the bridge more than Singapore. But Malaysia government fail to used a win-win approach in negotiation with Singapore, therefore, the negotiation fail. Singapore lose nothing if negotiation fail.

2 Users of the two crossing will subject to higher toll rate if government proceed to build the bridge. Thus, people should not upset over the cancellation. Only government would upset on it fail negotiation.

Updated Link : Global Voice Online

My Apple Menu: Singapore Surf

TechnoratiTag: Business Commentary Economics Economy Malaysia Opinion

Gainer

1 Link Kedua Sdn Bhd - Operator of Second Crossing between Malaysia and Singapore. The second link still have extra capacity and under utilize. If the causeway has been demolished. traffic in second link will increase. Link Kedua might able to increase it toll rate to boost traffic. However, recent fuel hike received unwelcome response from people. This might be one of the reason government do not wish to proceed with Scenic Bridge.

2 Gerbang Perdana Sdn Bhd - Whether the government would like to proceed to build the Scenic bridge or not Gerbang Perdana Sdn Bhd would gain from it. It the government proceed with the project. As a concession holder of the Scenic Bridge, Gerbang Perdana would be the main beneficiary. It get compensation if government do not wish to proceed with the project.

3 Johor Port and Port of Tanjung Pelepas - Both port control by bumiputra tycoon Tan Sri Syed Moktar. If Malaysia able to demolish the causeway and replace by a bridge. This would enhance the competitiveness of both port against Singapore. Syed Moktar also control 20% of Gerbang Perdana via DRB-Hicom group.

Loser

1 People from both country - People from both country will be subjected to higher toll rate once the causeway is being demolished.

2 Transporter - transporter, who is major user of the causeway and second link. Would have to pay higher toll rate.

3 Tax payer - Tax payer become loser especially government have to pay enormous compensation to Gerbang Perdana.

4 Port Authority of Singapore - Malaysia port become more competitive and this will eaten Singapore's market shares in port management.

Conclusion

1 Singapore's people and it port authority become the main loser if government proceed with Scenic Bridge. Thus, Singapore do not want the bridge and Malaysia need the bridge more than Singapore. But Malaysia government fail to used a win-win approach in negotiation with Singapore, therefore, the negotiation fail. Singapore lose nothing if negotiation fail.

2 Users of the two crossing will subject to higher toll rate if government proceed to build the bridge. Thus, people should not upset over the cancellation. Only government would upset on it fail negotiation.

Updated Link : Global Voice Online

My Apple Menu: Singapore Surf

TechnoratiTag: Business Commentary Economics Economy Malaysia Opinion

Wednesday, April 12, 2006

Shares price hit record high! What's next?

The Kuala Lumpur Composite Index (KLCI) rose to its highest level in nearly eight months with trading volume hitting a new record at over two billion shares, Asian markets, which climbed to 16-year highs, were aided by continued gains in their currencies that were led by the Chinese yuan, which hit a new post-revaluation high Last week.

Then property counter become another theme play by punter.

The question is: what happen next?

If you recall 1993 stock market bull run when the stock market is going up. The direct beneficiary is stockbroking firm and restaurant.

When stock trading volume goes up. The main beneficiaries are stock broking industry as their brokerage income would increase. Other profession like engineer would resigned to become a remisier. The only landscape difference is now the commission rate can be negotiated to substantially lower than in 1993. In 1993, commission rate is fixed at 1% of the transaction value but now commission can be as low as 0.3%, A 70% drop.

Punter might remember that in 1993, a stockbroking house market value can be as high as a commercial bank. At that point of time, we do not have universal broker. Now, a stockbroking company can become Investment Banker to collect deposit even brokerage margin has substantially lower. I do not understand why the outgoing Southern Bank Berhad substantial shareholder never negotiate to buy back it stock broking arm and Merchant Bank to form an Investment Bank. CIMB, which itself a leading Merchant Bank and it stockbroking arm a leading institutional trader, do not required Southern Bank Bhd's stockbroking arm and merchant bank. This is a poor exits strategy advised by a foreign adviser.

Another landscape different is now punter can directly buy a counter call Bursa Malaysia rather than punt on individual stock broking firm. If they unable to pick a counter. However, Bursa Malaysia shares price has rise substantially compare with stockbroking company.

If you see punter and retailer earning substantial money from the stock market. They will take their lunch in expensive restaurant and eat something like shark fin on a daily basis. You would find you unable to get a place in such restaurant during lunch time. Thus, I feel TT Resources Bhd is a good bet if stock market continues to rise.

TT Resources Bhd own Tai Thong Restaurant, It also own bridal houses. Other business included : Gloria Jeans Coffee and San Francisco Stake house.

Update: Brokers to gain from big turnover

Brokers are holding large stash of cash

Link: Investment Advisor

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

Then property counter become another theme play by punter.

The question is: what happen next?

If you recall 1993 stock market bull run when the stock market is going up. The direct beneficiary is stockbroking firm and restaurant.

When stock trading volume goes up. The main beneficiaries are stock broking industry as their brokerage income would increase. Other profession like engineer would resigned to become a remisier. The only landscape difference is now the commission rate can be negotiated to substantially lower than in 1993. In 1993, commission rate is fixed at 1% of the transaction value but now commission can be as low as 0.3%, A 70% drop.

Punter might remember that in 1993, a stockbroking house market value can be as high as a commercial bank. At that point of time, we do not have universal broker. Now, a stockbroking company can become Investment Banker to collect deposit even brokerage margin has substantially lower. I do not understand why the outgoing Southern Bank Berhad substantial shareholder never negotiate to buy back it stock broking arm and Merchant Bank to form an Investment Bank. CIMB, which itself a leading Merchant Bank and it stockbroking arm a leading institutional trader, do not required Southern Bank Bhd's stockbroking arm and merchant bank. This is a poor exits strategy advised by a foreign adviser.

Another landscape different is now punter can directly buy a counter call Bursa Malaysia rather than punt on individual stock broking firm. If they unable to pick a counter. However, Bursa Malaysia shares price has rise substantially compare with stockbroking company.

If you see punter and retailer earning substantial money from the stock market. They will take their lunch in expensive restaurant and eat something like shark fin on a daily basis. You would find you unable to get a place in such restaurant during lunch time. Thus, I feel TT Resources Bhd is a good bet if stock market continues to rise.

TT Resources Bhd own Tai Thong Restaurant, It also own bridal houses. Other business included : Gloria Jeans Coffee and San Francisco Stake house.

Update: Brokers to gain from big turnover

Brokers are holding large stash of cash

Link: Investment Advisor

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

Monday, April 10, 2006

Pensonic enter water filtration business

In Malaysia, poor quality of water provided by government has resulted water filtration become a big business. The market is dominated by franchise company like NESH and NEP's Diamond Energy Water and some other various direct selling company.

Pensonic is one of the listed Malaysian electrical home appliance company. Other Malaysian electrical home appliance company that listed on the stock exchange including, multinational Panasonic (Formerly known as Matsushita), air-conditional specialist OYL, manufacturer Khind, trader Pensonic which market product under the same brand and Fiamma Holding Bhd that have numerous brand that including Elba and MEC etc, and I Bhd . Of course, we have other numerous OEM manufacturer that list on the stock exchange. Such OEM manufacturer manufacture for numerous MNC brand but they do not have their own Malaysia brand.

Other than multinational Panasonic, Malaysia most competitive electrical home appliance industry is air-conditional manufacturer OYL as Malaysia is the largest air-conditional exporter in the world. Another Malaysia company that able to compete worldwide is Uchi Technologies Bhd, the company manufacture electronic coffee makers.

With the electrical home appliance slowly dominated by China's low cost manufacture goods. Malaysian company is difficult to become competitive in TV and audio market. Market rumors said that even air-conditional manufacturer OYL was up for sales. Thus, the only way to survive to compete with China low cost manufacturer is like how US and Europe company compete with Japanese a decade ago...... Venture into health care equipment like GE in US and Phillips in Europe.

Pensonic recent venture into water filter and purified system signified a good move by Malaysia electrical home appliance manufacturer. Earlier, Uchi Technologies Bhd also has announced boosting of biotechnology business.

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

Pensonic is one of the listed Malaysian electrical home appliance company. Other Malaysian electrical home appliance company that listed on the stock exchange including, multinational Panasonic (Formerly known as Matsushita), air-conditional specialist OYL, manufacturer Khind, trader Pensonic which market product under the same brand and Fiamma Holding Bhd that have numerous brand that including Elba and MEC etc, and I Bhd . Of course, we have other numerous OEM manufacturer that list on the stock exchange. Such OEM manufacturer manufacture for numerous MNC brand but they do not have their own Malaysia brand.

Other than multinational Panasonic, Malaysia most competitive electrical home appliance industry is air-conditional manufacturer OYL as Malaysia is the largest air-conditional exporter in the world. Another Malaysia company that able to compete worldwide is Uchi Technologies Bhd, the company manufacture electronic coffee makers.

With the electrical home appliance slowly dominated by China's low cost manufacture goods. Malaysian company is difficult to become competitive in TV and audio market. Market rumors said that even air-conditional manufacturer OYL was up for sales. Thus, the only way to survive to compete with China low cost manufacturer is like how US and Europe company compete with Japanese a decade ago...... Venture into health care equipment like GE in US and Phillips in Europe.

Pensonic recent venture into water filter and purified system signified a good move by Malaysia electrical home appliance manufacturer. Earlier, Uchi Technologies Bhd also has announced boosting of biotechnology business.

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

Friday, April 07, 2006

Negligent by Proton's directors?

On 28 March 2006, Proton chairman chairman Datuk Mohd Azlan Hashim said that Proton Holdings Bhd's board was not given full details of the acquisition of the debt-laden MV Agusta Motors SpA (MVAM) when the deal was executed in 2004. He said that the board was not aware that the MVAM minority shareholders had veto powers on 57.75% stake in MVAM was acquired for RM367.6 million (70 million euros) on Dec 1, 2004.

How can a director of the company treated a deal amounting to RM367.6 million that likely that they do not aware of there is a veto power imposed by minority of MV Agusta. Apparently they are negligent in performing their duty as a director and should tender resignation as director of the company.

Actually, such material event should be disclosed to all minority shareholder of Proton before the deal go through. Not disclosed only after the company has disposed off the shares at controversy 1 Euro. However, Proton has stated under clause 3.2 on Proton statement on the disposal of interest in MV Agusta Motors SpA that :

In so far as the regulatory obligations of a public listed company are concerned, Proton has complied with all necessary requirements of Bursa Malaysia. However, addressing the matter publicly was not an option until now, as the agreement to dispose of the interest in MVAM was conditional and restricted the ability of Proton to fully address the uninformed speculation in the public domain.

In addition, it was also felt that responding to the allegations prematurely would have detracted from the main issue at hand, which was to resolve the MVAM issue and avert the potential liability. All this is part of acting in the best interest of the shareholders.

Minority watchdog, can you accept such explanation?

Even minority watchdog willing to accept such explanation. Can directors just claim that they are not aware there is a veto power on a deal that amounting to million and disclaim responsibility. It look like any person walking on the street is more brilliant and competent than Proton's director. What is the point of Company Commission of Malaysia or Suruhanjaya Syarikat Malaysia (SSM) required directors to attend course but director need not resigned from their position after a negligent has occur?

Other that the veto power. The founder of MV Agusta also has an anti-dilution clauses that protect the founder's interest. This was not disclosed to minority shareholder of at the time of acquiring MV Agusta. Only disclosed to the public on 28 March 2006 after disposed off the investment at controversy one Euro.

No disclosure make to minority shareholder when Proton exposure to bankruptcy risk cause by unique legal framework of Italy, where debt of subsidiary MV Agusta can cause a holding company Proton bankrupt.

Of course, Proton advisor Tun Dr Mahathir Mohamad is not convinced on the explanation.

However, can we just close off the issue like this?

TechnoratiTag: Business Commentary competitive Economics Economy Malaysia Opinion finance Shares Stock Market klse

How can a director of the company treated a deal amounting to RM367.6 million that likely that they do not aware of there is a veto power imposed by minority of MV Agusta. Apparently they are negligent in performing their duty as a director and should tender resignation as director of the company.

Actually, such material event should be disclosed to all minority shareholder of Proton before the deal go through. Not disclosed only after the company has disposed off the shares at controversy 1 Euro. However, Proton has stated under clause 3.2 on Proton statement on the disposal of interest in MV Agusta Motors SpA that :

In so far as the regulatory obligations of a public listed company are concerned, Proton has complied with all necessary requirements of Bursa Malaysia. However, addressing the matter publicly was not an option until now, as the agreement to dispose of the interest in MVAM was conditional and restricted the ability of Proton to fully address the uninformed speculation in the public domain.